Research Methodology Water and Wastewater Treatment Equipment Market

Introduction

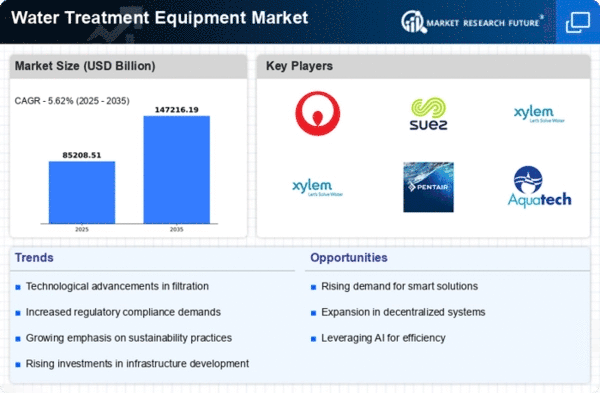

The research report by Market Research Future aims to study and analyze the global water and wastewater treatment equipment market. This report includes a detailed market analysis of the global water and wastewater treatment equipment market across several regions and countries. In this research report, MRFR has collected and examined various quantitative data related to the aspects such as market size, market share, market value, region and country-wise market growth and so forth. In order to effectively analyze the market data and generate a consensus, and to cater this research methodology is based on triangulation and primary and secondary research techniques.

Research Objectives

The main objectives of this research report are to:

- To analyze and forecast the global water and wastewater treatment equipment market size.

- To identify market trends and opportunities in the water and wastewater treatment equipment market.

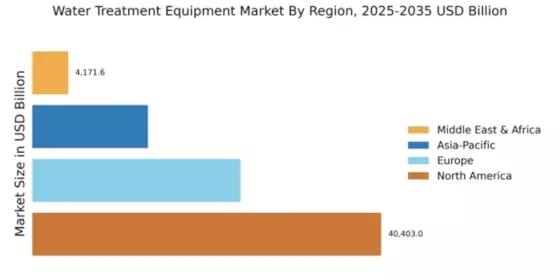

- To study the regional and country-wise water and wastewater treatment equipment market.

- To analyze and forecast the water and wastewater treatment equipment market by segment.

- To identify the driving factors and opportunities in the water and wastewater treatment equipment market.

- To profile the key players in the water and wastewater treatment equipment market and comprehensively analyze their market share and core competencies.

Research Scope

The research scope of this study includes the following:

- Detailed market analysis of the global water and wastewater treatment equipment market for the period 2023-2030.

- Water and wastewater treatment equipment market segmentation by type, application, and geography.

- Assessment of the past and current market trends, potential opportunities and drivers in the water and wastewater treatment equipment market.

- Analysis of the competitive landscape of the water and wastewater treatment equipment market, including key players such as vendors, manufacturers, and service providers.

Research Methodology

In order to provide insights and different perspectives on the global water and wastewater treatment equipment market, we have used a combination of primary and secondary research methodologies. Primary research is conducted using interviews with industry experts and key industry players. MRFR conducted industry surveys to collect data and firsthand information on the current structure and characteristics of the water and wastewater treatment equipment market. The primary research includes interviews with industry experts and industry players, industry surveys, statistical analysis, organizational reports, annual reports, press releases and refereed journals.

Secondary research includes industry magazines and directories, government sources, reports and databases such as Bloomberg, Businessweek, research papers and other sources. We have also used various financial and stock exchange websites to collate additional data. All the data obtained from the primary and secondary sources have been cross analyzed to remove discrepancies and dependencies on external factors.

Market Estimation

The published research report estimates the global water and wastewater treatment equipment market for the forecast period 2023–2030. MRFR has divided the water and wastewater treatment equipment market into five regions and key countries, and within each region, and further divided the market into segments based on the type, application and geography. Based on secondary and primary research data collected from various vendors and industry veterans, we have estimated the market size from the supply and demand sides.

MRFR utilizes historic market data from 2019 to forecast the market's growth for 2023-2030. The report also analyzes the data collected from various sources to derive the average market size estimates and also employs multiple primary and secondary research strategies to estimate the market size in each region and country. Furthermore, the data is validated using the triangulation method.

Data Triangulation

In order to provide an accurate estimate of the global water and wastewater treatment equipment market size and forecast, the study employs a data triangulation method. This consists of the following steps:

First, the key elements of the water and wastewater treatment equipment market are analyzed, such as market value, market size, key industry players, product segmentation and market dynamics.

- Then primary research is conducted to collect market data for each identified element. The primary research includes interviews with industry veterans and industry players.

- Secondary research is conducted to verify the primary research data and to cross-check the accuracy of the data collected from various sources.

- The data collected from primary and secondary sources is cross verified to identify and remove discrepancies.

- The data is then analyzed, and the market size is estimated for each segment and for each region and country.

Assumptions

This research report is based on certain assumptions, which are as follows:

- The report assumes that the market growth and size of the water and wastewater treatment equipment market will remain stable in the forecast period.

- The report assumes that the market data collected from primary and secondary resources is accurate and reliable.

- The report assumes that various macroeconomic and geopolitical factors will drive the water and wastewater treatment equipment market growth.

Report Summary

This study is a comprehensive market analysis of the global water and wastewater treatment equipment market. The report provides a detailed market analysis for the period 2023-2030 and provides market size, forecast, region and country-wise trends in the market, and a detailed analysis of key players and their market strategies.

The research methodology adopted in this report is based on primary and secondary research and the triangulation method. The report contains detailed market estimation and analysis of the global water and wastewater treatment equipment market.