Market Share

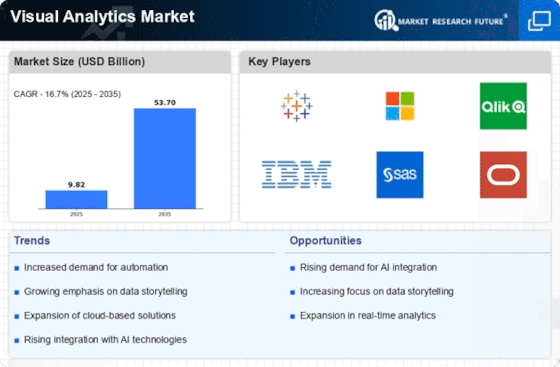

Visual Analytics Market Share Analysis

The Visual Analytics market space is getting increasingly complex. Matter of speaking, there arises competition for the piece of the market share among different companies fighting their way up. Organizations which work so much, of course at various sectors use diverse positioning methods to cut themselves out and to focus on the audience they want. A popular approach is item diversification: companies focus on offering broad and diverse visual textures. This could pass all the firewalls, breathtaking original components, and simple deft engineering already beyond the opponents. These features will be used to market, projects and possibly attract consumers interested in specific functions or unique customers experiences.

A method that contributes toward characterization of a historical figure of interest is the approach of placing. Certain Visual Analytics market players find the niche of price chasers and come out with the cost-saving yet quality-first solutions. This is cost sensitive targets and with the said aim of attaining marketing premium by giving out incentives for paying in cash. On one side, some organizations claiming to be of high scores and expertize show up and insist on the best quality of their visual analytics performance while some others creates competitors with higher rating and advanced technicalities of their equipment. Companies took advantage of this marketing strategy by pinpointing individuals with the financial capability of putting more to get the best products and results. Among considering and assessing both promotion and downgrading of an organization's position, always access to harmony becomes a vital point when talking about sustainability of an enterprise in this competitive market.

Market division, which can be considered one of the most prominent forms in Visual Analytics, plays a pivotal role in this approach, which is made possible through the combined use of data visualization, data exploration, and interactive User Interfaces. Companies brand their products line up so that to match prudent industry verticals or specialty market models and satisfy the specific needs. By targeting the needs that form the segment of the market and making sure that their products are in line with them, businesses build the reputation of being the authorities in a specific field, gaining credibility and respect from the market. In contrast, this specialized way will involve far more hands-on marketing campaigns and an all in all greater awareness and understanding of what our customers really need. Consequently, better market shares will be reached in the chosen segment.

Besides stocking, placing, and exercising location management strategy, organizations and alliances have a vital role in the share of market. Several related businesses in the visual analytics field are structuring strategic alliances with stakeholders like technology partners, data suppliers, or other industry counterparts. Such networks can reward existing incentives with corresponding innovations or more diverse information sources. From the damage to sea life and habitats to excessive waste production, these environmental consequences threaten both wildlife and the precious ecosystems on which we rely. Hence, the business puts itself alongside with lucrative collaborators who are part and parcel of a large-scale ecosystem, creating a good image of its own brand and increases its visibility in the market.

Leave a Comment