Market Growth Projections

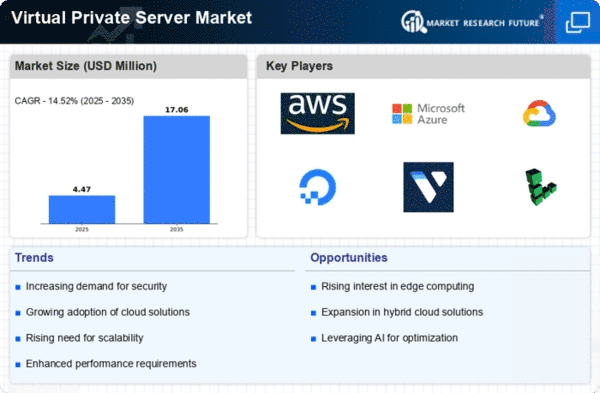

The Global Virtual Private Server Market Industry is poised for substantial growth, with projections indicating a market size of 3.95 USD Billion in 2024 and an impressive increase to 15.4 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 13.15% from 2025 to 2035. Such figures highlight the increasing reliance on VPS solutions across various sectors, driven by factors such as cost efficiency, security, and the need for scalable resources. The market dynamics indicate a robust future for VPS technologies, reflecting the evolving demands of businesses in a digital-first world.

Emergence of Remote Work Trends

The emergence of remote work trends is reshaping the Global Virtual Private Server Market Industry. As more organizations adopt flexible work arrangements, the need for reliable and secure remote access to company resources becomes paramount. VPS solutions offer a viable option for businesses to provide employees with secure environments to access applications and data from various locations. This shift not only enhances productivity but also necessitates robust IT infrastructure, driving the demand for VPS services. The anticipated growth of the market to 15.4 USD Billion by 2035 reflects the long-term implications of remote work on the Global Virtual Private Server Market Industry.

Increased Focus on Data Security

In the current landscape, the Global Virtual Private Server Market Industry is witnessing heightened emphasis on data security. As cyber threats become more sophisticated, businesses are prioritizing secure hosting environments. VPS solutions often provide enhanced security features, such as dedicated IP addresses and customizable firewalls, which appeal to organizations handling sensitive information. This focus on security is driving adoption rates, as companies seek to mitigate risks associated with data breaches. The anticipated growth of the market to 15.4 USD Billion by 2035 underscores the importance of security in influencing purchasing decisions within the Global Virtual Private Server Market Industry.

Expansion of E-Commerce Platforms

The expansion of e-commerce platforms is a pivotal driver for the Global Virtual Private Server Market Industry. As online retail continues to flourish, businesses require reliable hosting solutions to support their operations. VPS provides the necessary resources to handle increased traffic and transactions, ensuring optimal performance during peak periods. This demand is further amplified by the need for scalability, allowing e-commerce businesses to adjust their resources according to fluctuating market conditions. The growth trajectory of the market, projected to reach 3.95 USD Billion in 2024, highlights the critical role VPS plays in supporting the burgeoning e-commerce sector within the Global Virtual Private Server Market Industry.

Growing Adoption of Cloud Computing

The Global Virtual Private Server Market Industry is significantly influenced by the growing adoption of cloud computing technologies. As organizations increasingly migrate their operations to the cloud, the demand for VPS solutions that offer both flexibility and control rises. VPS allows businesses to leverage cloud benefits while maintaining a degree of isolation from other users, which is particularly appealing for those concerned about performance and security. This trend is expected to contribute to a compound annual growth rate of 13.15% from 2025 to 2035, reflecting the ongoing transformation in how businesses utilize technology within the Global Virtual Private Server Market Industry.

Rising Demand for Cost-Effective Solutions

The Global Virtual Private Server Market Industry experiences a notable surge in demand for cost-effective hosting solutions. Businesses, particularly small to medium-sized enterprises, are increasingly adopting VPS due to its affordability compared to dedicated servers. With the market projected to reach 3.95 USD Billion in 2024, organizations are drawn to the flexibility and scalability that VPS offers. This trend indicates a shift in how companies allocate their IT budgets, favoring solutions that provide robust performance without the high costs associated with traditional hosting. As a result, the Global Virtual Private Server Market Industry is likely to expand significantly.