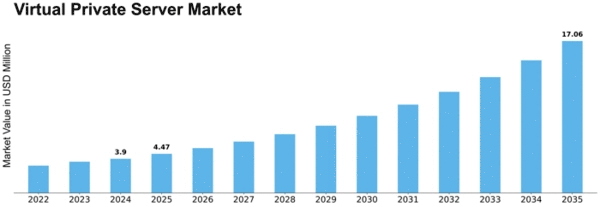

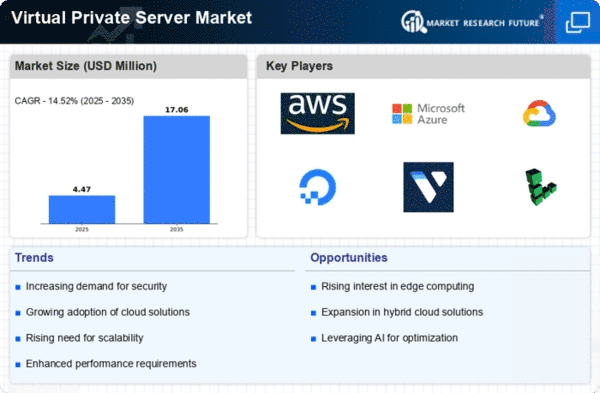

Virtual Private Server Size

Virtual Private Server Market Growth Projections and Opportunities

As more and more organizations bring their operations online, the need for efficient and flexible services is growing larger all of the time. Virtual private servers (VPSs), for example, offer companies the opportunity to have their own resources at smaller prices than those charged by dedicated servers or shared hosting. Along with the surge in SMEs migrating online, these factors are boosting development of this industry. Technological developments also have a great impact on the VPS industry. Increasingly popular cloud-based solutions and the ever shifting face of virtualization are driving growth in this market. This source of savings exists because virtual private server providers can create multiple isolated virtual servers on the same piece of physical hardware. They do this by using a technique called “virtualization.” Cloud infrastructure has made VPS even more scalable and accessible to businesses in need of fast, flexible hosting solutions. Another consideration for the industry is security. As the sophistication of cyber attacks increases, businesses are highlighting hosting solutions with strong security features. Because VPS offers separated server environments, it is more secure than shared hosting. This function encourages companies handling sensitive information-- such as client records or financial transactions- to use virtual private server hosting. Because service providers are always trying to find new ways of securing their customers, the industry is quick to adopt novel security procedures and features. A number of economic variables affect the virtual private server industry. Cheap is good At difficult times for business, VPS solutions are especially popular. Most businesses are penny-wise, so the flexibility to increase resources only when needed and on demand while still not needing expensive dedicated servers is a good fit. Secondly, the industry is attractive because VPS providers employ competitive pricing strategies. As a result, all manner of enterprises are likely to have access to and benefit from use of VMS hosting services. Vendor strategy and market competitiveness are two key factors influencing the environment of the VPS. The industry is full of service providers offering the same thing, so competition is fierce. Provider differentiation occurs in performance, customer service and extra features. To obtain an edge in competition, it is usually necessary to constantly create new service offerings and add value added services. In today's dynamic VPS market, providers who offer low-priced yet high quality services will be the ones to stand out.

Leave a Comment