Rising Pet Ownership

The Veterinary Laboratory Testing Market is experiencing growth due to the increasing number of pet owners. As more households adopt pets, the demand for veterinary services, including laboratory testing, rises. In recent years, pet ownership rates have surged, with estimates indicating that approximately 67% of households own a pet. This trend is likely to continue, as pet owners increasingly view their animals as family members, leading to a greater emphasis on health and wellness. Consequently, veterinary laboratories are witnessing a higher volume of diagnostic tests, which is essential for preventive care and early disease detection. This growing pet ownership trend is expected to drive the Veterinary Laboratory Testing Market further, as owners seek comprehensive health assessments for their pets.

Increase in Zoonotic Diseases

The rise in zoonotic diseases is a critical driver for the Veterinary Laboratory Testing Market. As the incidence of diseases that can be transmitted from animals to humans increases, there is a growing need for effective diagnostic testing. Public health concerns surrounding zoonotic diseases, such as rabies and leptospirosis, have prompted both veterinarians and pet owners to prioritize laboratory testing. The World Health Organization has indicated that zoonotic diseases account for a significant portion of emerging infectious diseases. This awareness is likely to lead to increased investments in veterinary diagnostics, thereby bolstering the Veterinary Laboratory Testing Market.

Regulatory Changes and Compliance

The Veterinary Laboratory Testing Market is also influenced by evolving regulatory frameworks and compliance requirements. Governments and veterinary associations are implementing stricter guidelines to ensure the quality and safety of veterinary diagnostics. These regulations often necessitate regular testing and monitoring of animal health, which in turn drives demand for laboratory services. Compliance with these standards is crucial for veterinary practices, as it affects their credibility and operational efficiency. As regulations continue to tighten, veterinary laboratories are likely to see an increase in testing volumes, thereby contributing to the growth of the Veterinary Laboratory Testing Market.

Growing Awareness of Animal Health

There is a notable increase in awareness regarding animal health and welfare, which is positively impacting the Veterinary Laboratory Testing Market. Pet owners are becoming more informed about the importance of regular health check-ups and preventive care. This heightened awareness is leading to an increase in routine laboratory tests, such as blood work and screenings for infectious diseases. Reports suggest that the veterinary diagnostics market is expected to grow at a rate of 7.5% annually, driven by this trend. As pet owners prioritize their animals' health, the demand for laboratory testing services is likely to rise, thereby enhancing the Veterinary Laboratory Testing Market.

Advancements in Diagnostic Technologies

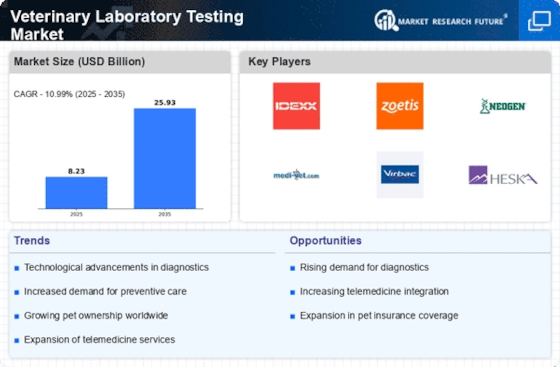

Technological innovations are significantly influencing the Veterinary Laboratory Testing Market. The introduction of advanced diagnostic tools, such as molecular diagnostics and point-of-care testing, enhances the accuracy and speed of test results. These advancements allow veterinarians to make informed decisions quickly, improving patient outcomes. For instance, the market for veterinary diagnostics is projected to reach USD 3.5 billion by 2026, reflecting a compound annual growth rate of around 8%. Such growth is indicative of the increasing reliance on sophisticated laboratory testing methods. As these technologies become more accessible and affordable, veterinary practices are likely to invest in them, further propelling the Veterinary Laboratory Testing Market.