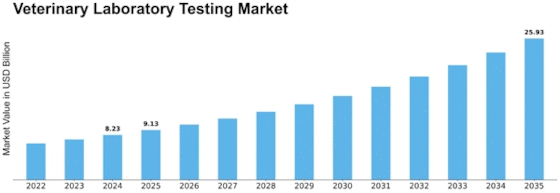

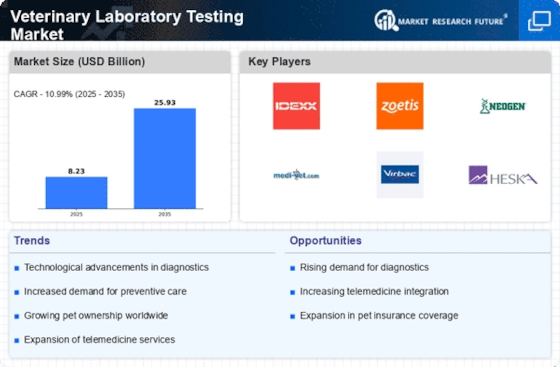

Veterinary Laboratory Testing Size

Veterinary Laboratory Testing Market Growth Projections and Opportunities

The Veterinary Laboratory Testing market is witnessing a boom driven by a global increase in puppy possession. As more humans welcome pets into their houses, there's a parallel upward thrust in spending on veterinary offerings, along with laboratory checking out for preventive care, diagnostics, and treatment-making plans. A shift in puppy healthcare towards preventive measures is influencing the Veterinary Laboratory Testing market. Pet owners are increasingly opting for routine laboratory tests to locate early symptoms of illnesses, contributing to the demand for comprehensive veterinary diagnostics. Technological improvements in diagnostic tools and laboratory systems are transforming the veterinary testing panorama. Innovations along with molecular diagnostics, superior imaging techniques, and factor-of-care testing are improving the accuracy and performance of veterinary laboratory diagnostics, using market increase. The incidence of zoonotic sicknesses and the potential transmission of diseases among animals and human beings have heightened awareness of the significance of Veterinary Laboratory Testing. This concern for public fitness is riding accelerated checking out for diseases that have implications for each animal and human population. The upward thrust of specialty and reference laboratories dedicated to veterinary diagnostics is an amazing marketplace fashion. These laboratories provide specialized checking-out offerings, catering to animal species or kinds of tests, offering veterinarians and puppy proprietors access to a wider variety of diagnostic abilities. In the agricultural area, concerns about cattle fitness and food protection are influencing the Veterinary Laboratory Testing marketplace. Farmers and manufacturers are more and more counting on laboratory testing to monitor and ensure the fitness of their farm animals, in addition to complying with meal protection guidelines. The adoption of telemedicine in veterinary care is impacting the Veterinary Laboratory Testing market. Remote consultations with veterinarians regularly involve the recommendation of laboratory checks, using the want for available and green testing offerings that can help telehealth initiatives in veterinary medicinal drugs. The globalization of the veterinary laboratory testing market is obvious as groups expand their operations to serve a broader geographical market. This growth is fueled by the increasing demand for superior diagnostic offerings in both evolved and rising economies.

Leave a Comment