Rising Demand for Pet Healthcare

The Veterinary Biomarkers Market is experiencing a notable surge in demand for pet healthcare services. As pet ownership continues to rise, owners are increasingly seeking advanced diagnostic tools to ensure the health and well-being of their animals. This trend is reflected in the growing expenditure on veterinary services, which has been projected to reach approximately 30 billion dollars by 2026. The increasing awareness of preventive healthcare and the importance of early disease detection are driving the adoption of biomarkers in veterinary diagnostics. Consequently, this heightened focus on pet health is likely to propel the Veterinary Biomarkers Market forward, as stakeholders seek innovative solutions to meet the evolving needs of pet owners.

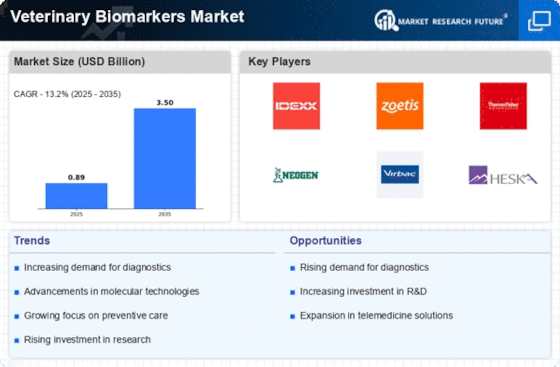

Advancements in Biomarker Research

Recent advancements in biomarker research are significantly influencing the Veterinary Biomarkers Market. Innovations in genomics, proteomics, and metabolomics are paving the way for the development of novel biomarkers that can enhance disease detection and monitoring in animals. For instance, the identification of specific biomarkers associated with various diseases has the potential to improve diagnostic accuracy and treatment outcomes. The market is projected to grow at a compound annual growth rate of around 10% over the next few years, driven by these scientific breakthroughs. As research continues to evolve, the Veterinary Biomarkers Market is likely to witness an influx of new products and technologies that cater to the needs of veterinarians and pet owners alike.

Increasing Focus on Preventive Care

The Veterinary Biomarkers Market is witnessing a paradigm shift towards preventive care in veterinary medicine. This shift is largely driven by the recognition that early detection of diseases can lead to better health outcomes for animals. As a result, there is a growing emphasis on the use of biomarkers for routine health screenings and monitoring. The market for preventive veterinary care is expected to expand, with estimates suggesting it could reach 20 billion dollars by 2025. This trend is encouraging veterinary professionals to adopt biomarker-based diagnostics, thereby enhancing the overall quality of care provided to pets. Consequently, the Veterinary Biomarkers Market stands to benefit from this increasing focus on preventive health measures.

Regulatory Support and Standardization

Regulatory support for the development and approval of veterinary biomarkers is playing a crucial role in shaping the Veterinary Biomarkers Market. Governments and regulatory bodies are increasingly recognizing the importance of biomarkers in improving animal health and welfare. Initiatives aimed at streamlining the approval process for biomarker-based diagnostics are likely to foster innovation and encourage investment in this sector. Furthermore, the establishment of standardized protocols for biomarker validation is expected to enhance the credibility and reliability of these diagnostic tools. As regulatory frameworks evolve, the Veterinary Biomarkers Market is poised for growth, as stakeholders gain confidence in the efficacy and safety of biomarker applications.

Growing Investment in Veterinary Research

Investment in veterinary research is a key driver of the Veterinary Biomarkers Market. Increased funding from both public and private sectors is facilitating the exploration of new biomarkers and their applications in veterinary medicine. Research initiatives focused on understanding animal diseases and developing innovative diagnostic tools are gaining momentum. This influx of investment is likely to accelerate the pace of discovery and commercialization of veterinary biomarkers. As a result, the Veterinary Biomarkers Market is expected to expand, with new products entering the market that address unmet needs in animal health diagnostics. The commitment to advancing veterinary research underscores the potential for growth in this dynamic market.