Advancements in Biomarker Research

Ongoing advancements in biomarker research are significantly influencing the cardiac biomarkers market. The development of novel biomarkers, which can provide more accurate and timely information about cardiac health, is transforming diagnostic practices. Innovations in proteomics and genomics are leading to the identification of new biomarkers that can detect heart diseases at earlier stages. The Global Cardiac Biomarkers Industry is benefiting from these scientific breakthroughs, as they enable healthcare professionals to make informed decisions regarding patient management. Moreover, the integration of artificial intelligence and machine learning in biomarker analysis is enhancing the precision of diagnostics. This evolution in research not only improves patient care but also opens new avenues for market growth, as healthcare providers increasingly adopt these advanced diagnostic tools.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the cardiac biomarkers market. Tailoring treatment plans based on individual patient profiles is becoming increasingly feasible with the advent of advanced biomarkers. This approach allows for more effective management of cardiovascular diseases, as therapies can be customized to meet the specific needs of patients. The Global Cardiac Biomarkers Industry is likely to expand as healthcare providers recognize the value of personalized diagnostics in improving patient outcomes. Additionally, the increasing availability of genetic testing and biomarker profiling is facilitating this trend, enabling clinicians to make more informed decisions. As a result, the market is expected to witness a rise in demand for biomarkers that support personalized treatment strategies, ultimately enhancing the overall quality of care.

Regulatory Support for Biomarker Development

Regulatory bodies are increasingly supporting the development and approval of cardiac biomarkers, which is a crucial driver for the market. Streamlined approval processes and guidelines for biomarker validation are encouraging companies to invest in research and development. This regulatory support is vital for The Global Cardiac Biomarkers Industry, as it fosters innovation and expedites the introduction of new diagnostic tools. Furthermore, collaborations between regulatory agencies and industry stakeholders are enhancing the overall ecosystem for biomarker development. As a result, the market is likely to experience accelerated growth, with more biomarkers entering the market to meet the rising demand for effective cardiovascular diagnostics. This supportive environment not only benefits manufacturers but also ensures that patients have access to the latest advancements in cardiac care.

Rising Investment in Healthcare Infrastructure

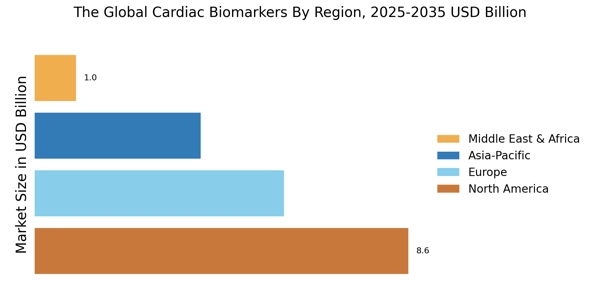

The increasing investment in healthcare infrastructure is a significant driver for the cardiac biomarkers market. Governments and private entities are allocating substantial resources to enhance healthcare facilities and diagnostic capabilities. This trend is particularly evident in emerging economies, where the demand for advanced diagnostic tools is on the rise. The Global Cardiac Biomarkers Industry stands to benefit from these investments, as improved healthcare infrastructure facilitates the adoption of innovative biomarkers. Enhanced laboratory facilities and diagnostic centers are likely to lead to increased testing and monitoring of cardiovascular diseases. Moreover, as healthcare systems evolve, the integration of cardiac biomarkers into routine clinical practice is expected to become more prevalent, further propelling market growth. This investment trend underscores the commitment to improving patient care and outcomes in the realm of cardiovascular health.

Increasing Prevalence of Cardiovascular Diseases

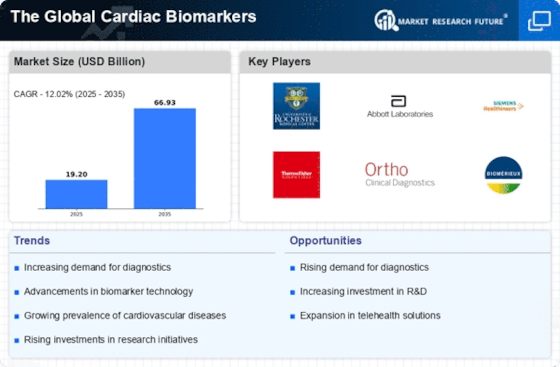

The rising incidence of cardiovascular diseases is a primary driver for the cardiac biomarkers market. As heart-related ailments continue to escalate, the demand for effective diagnostic tools becomes paramount. According to recent statistics, cardiovascular diseases account for a significant portion of global mortality rates, prompting healthcare systems to seek innovative solutions. The Global Cardiac Biomarkers Industry is witnessing a surge in the development of biomarkers that can facilitate early detection and monitoring of heart conditions. This trend is likely to enhance patient outcomes and reduce healthcare costs associated with late-stage interventions. Furthermore, the increasing awareness among patients regarding heart health is expected to further propel the demand for cardiac biomarkers, thereby shaping the market landscape in the coming years.