Advancements in Biomarker Technologies

Technological innovations in biomarker discovery and validation are significantly influencing the Central Nervous System Biomarkers Market. The advent of high-throughput screening methods, next-generation sequencing, and advanced imaging techniques has enhanced the ability to identify and validate biomarkers with greater accuracy and efficiency. For instance, liquid biopsy technologies are emerging as a non-invasive method for detecting biomarkers associated with neurological diseases. These advancements not only improve diagnostic capabilities but also facilitate the development of personalized medicine approaches, which are increasingly favored in the treatment of neurological disorders. As a result, the market is expected to witness substantial growth, driven by the integration of cutting-edge technologies in biomarker research.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the Central Nervous System Biomarkers Market. As healthcare moves away from a one-size-fits-all approach, there is a growing emphasis on tailoring treatments to individual patients based on their unique biomarker profiles. This trend is particularly evident in the treatment of neurological disorders, where understanding the specific biological mechanisms underlying a patient's condition can lead to more effective therapies. The market for personalized medicine is projected to grow significantly, with estimates suggesting it could reach over 2 trillion by 2025. This growth is likely to drive demand for biomarkers that can facilitate personalized treatment strategies, thereby enhancing the Central Nervous System Biomarkers Market.

Rising Prevalence of Neurological Disorders

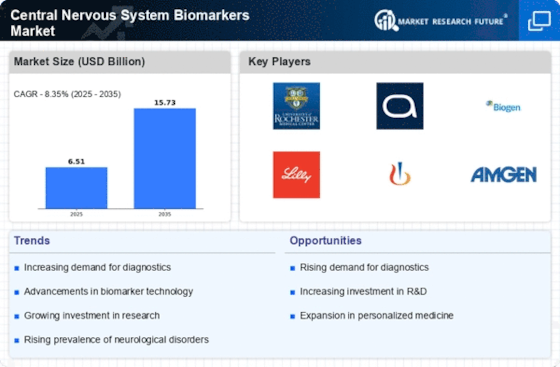

The increasing incidence of neurological disorders such as Alzheimer's disease, Parkinson's disease, and multiple sclerosis is a primary driver for the Central Nervous System Biomarkers Market. As the population ages, the demand for effective diagnostic tools and treatments intensifies. According to recent estimates, the prevalence of Alzheimer's disease is projected to reach 14 million cases by 2060, underscoring the urgent need for biomarkers that can facilitate early diagnosis and monitoring. This trend is likely to propel investments in biomarker research and development, thereby expanding the market. Furthermore, the growing awareness of mental health issues is also contributing to the demand for biomarkers that can aid in the diagnosis of conditions like depression and anxiety, further driving the Central Nervous System Biomarkers Market.

Regulatory Support for Biomarker Development

Regulatory agencies are increasingly providing support for the development and validation of biomarkers, which is a key driver for the Central Nervous System Biomarkers Market. Initiatives aimed at streamlining the approval process for biomarker-based diagnostics are being implemented, allowing for faster access to innovative solutions in the market. For example, the FDA has established programs to expedite the review of biomarkers that demonstrate potential in improving patient outcomes. This regulatory support not only encourages investment in biomarker research but also fosters collaboration between academia and industry. As a result, the Central Nervous System Biomarkers Market is likely to experience accelerated growth, driven by the favorable regulatory environment.

Increased Investment in Research and Development

The surge in funding for research and development in the field of neurology is a crucial driver for the Central Nervous System Biomarkers Market. Governments and private organizations are increasingly recognizing the importance of biomarkers in understanding and treating neurological disorders. In recent years, funding for neuroscience research has seen a notable increase, with billions allocated to various initiatives aimed at discovering novel biomarkers. This influx of capital is likely to accelerate the pace of research, leading to the identification of new biomarkers that can improve diagnostic accuracy and treatment outcomes. Consequently, the Central Nervous System Biomarkers Market stands to benefit from this heightened focus on R&D, as new discoveries translate into market opportunities.