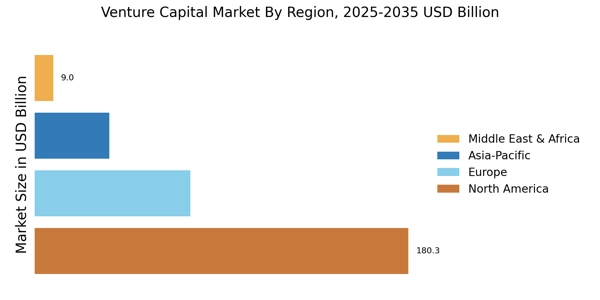

North America : Venture Capital Market Powerhouse

North America remains the largest market for venture capital, accounting for approximately 60% of global investments. North America leads global venture capital market news, driven by strong venture capital funds, vc companies, and mature startup ecosystems. The region's growth is driven by a robust startup ecosystem, technological advancements, and favorable regulatory frameworks. The U.S. leads in venture capital funding, with California and New York being the primary hubs. The increasing demand for innovative solutions in sectors like fintech, health tech, and AI further fuels this growth. The competitive landscape is characterized by major players such as Sequoia Capital, Andreessen Horowitz, and Benchmark, which dominate the funding scene. The presence of numerous unicorns and a strong network of incubators and accelerators enhances the attractiveness of the region. Additionally, government initiatives supporting entrepreneurship and innovation contribute to a thriving venture capital environment, solidifying North America's position as a leader in the global market.

Europe : Emerging Venture Capital Market Hub

Europe is rapidly emerging as a significant player in the venture capital market, holding approximately 25% of global investments. Europe’s growth reflects increasing venture capital funding, regulatory support, and strong participation from venture capital investors.The region benefits from a diverse range of industries, including technology, healthcare, and renewable energy, driving demand for venture funding. Regulatory support, such as the European Investment Fund's initiatives, has catalyzed growth, making it easier for startups to access capital and scale their operations. Leading countries like the UK, Germany, and France are at the forefront of this growth, with London being a major financial center for venture capital. The competitive landscape features key players like Index Ventures and Accel, which are instrumental in funding innovative startups. The increasing collaboration between public and private sectors further enhances the venture capital ecosystem, positioning Europe as a formidable competitor in the global market.

Asia-Pacific : Rapidly Growing Investment Landscape

Asia-Pacific is witnessing a significant surge in venture capital investments, accounting for around 12% of the global market. Asia-Pacific is witnessing accelerated vc investment, particularly in India and China, supported by rising venture capital venture capital activity and global investor interest. The region's growth is fueled by a booming startup ecosystem, particularly in countries like China and India, where technology adoption and digital transformation are accelerating. Government initiatives aimed at fostering entrepreneurship and innovation are also key drivers, creating a favorable environment for venture capital investments. China leads the region in venture capital funding, with a strong presence of tech giants and a vibrant startup culture. India follows closely, with a growing number of unicorns and a diverse range of sectors attracting investments. The competitive landscape includes prominent players like Sequoia Capital and GV, which are actively investing in innovative startups. The increasing interest from global investors further enhances the region's appeal in the venture capital market.

Middle East and Africa : Emerging Investment Opportunities

The Middle East and Africa region is gradually emerging in the venture capital landscape, holding about 3% of global investments. MEA markets are gaining attention as new capital venture destinations for venture capital investors. The growth is driven by a young population, increasing internet penetration, and a burgeoning tech ecosystem. Countries like the UAE and South Africa are leading the charge, supported by government initiatives aimed at fostering innovation and entrepreneurship, which are crucial for attracting venture capital investments. The competitive landscape is evolving, with local and international players increasingly investing in startups across various sectors, including fintech and e-commerce. The presence of key players and accelerators is enhancing the region's attractiveness for venture capital. As the ecosystem matures, the potential for growth in venture capital investments is significant, positioning the Middle East and Africa as a promising market for future investments.