Rise of Technology Startups

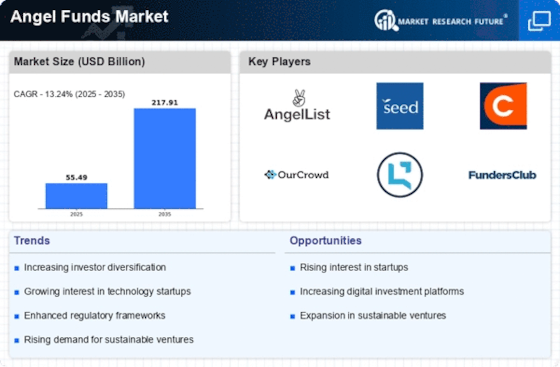

The Angel Funds Market is experiencing a notable surge in technology startups, which are increasingly attracting angel investors. This trend is driven by the rapid advancement of technology and the growing demand for innovative solutions across various sectors. In 2025, it is estimated that technology startups will account for approximately 40% of all angel investments, reflecting a shift in investor focus towards high-growth potential sectors. The proliferation of digital platforms and tools has made it easier for entrepreneurs to launch tech-based ventures, thereby expanding the pool of investment opportunities within the Angel Funds Market. Furthermore, the increasing reliance on technology in everyday life suggests that investors may continue to prioritize tech startups, potentially leading to a more dynamic and competitive investment landscape.

Increased Regulatory Support

The Angel Funds Market is benefiting from increased regulatory support aimed at fostering entrepreneurship and innovation. Governments in various regions are implementing policies that encourage angel investing, such as tax incentives and streamlined investment processes. For instance, recent legislative changes have made it easier for angel investors to participate in funding rounds, thereby enhancing the attractiveness of the Angel Funds Market. This regulatory environment is expected to stimulate investment activity, with projections indicating a potential increase in angel funding by 15% over the next year. Such supportive measures not only bolster investor confidence but also create a more favorable ecosystem for startups seeking capital, ultimately driving growth within the Angel Funds Market.

Expansion of Investment Networks

The Angel Funds Market is experiencing an expansion of investment networks, which facilitate connections between investors and startups. These networks, often organized through online platforms, enable angel investors to discover new opportunities and collaborate with other investors. The rise of such networks is indicative of a broader trend towards community-driven investment approaches, where shared knowledge and resources enhance decision-making. In 2025, it is anticipated that the number of active angel investment networks will increase by 20%, further diversifying the Angel Funds Market. This expansion not only broadens the reach of capital to startups but also fosters a collaborative environment that can lead to more informed investment choices.

Growing Interest in Impact Investing

The Angel Funds Market is witnessing a growing interest in impact investing, where investors seek to generate social and environmental benefits alongside financial returns. This trend is particularly pronounced among younger investors who prioritize sustainability and ethical considerations in their investment decisions. In recent years, the percentage of angel investments directed towards impact-driven startups has increased significantly, with estimates suggesting that this could reach 25% by the end of 2025. This shift indicates a broader movement within the Angel Funds Market towards supporting ventures that align with personal values and societal needs. As awareness of global challenges rises, the demand for impact investments is likely to continue to grow, potentially reshaping the investment landscape.

Emergence of Alternative Funding Models

The Angel Funds Market is witnessing the emergence of alternative funding models that complement traditional angel investing. Crowdfunding platforms and revenue-based financing are gaining traction, providing startups with diverse avenues for raising capital. These models appeal to both entrepreneurs and investors, as they offer flexibility and reduced risk. In 2025, it is projected that alternative funding methods will account for approximately 30% of total angel investments, reflecting a shift in how startups secure funding. This diversification within the Angel Funds Market may lead to increased competition among funding sources, ultimately benefiting entrepreneurs by providing them with more options to finance their ventures.