Rise of Millennial and Gen Z Investors

The Impact Investing Market is experiencing a demographic shift as Millennial and Gen Z investors increasingly enter the market. These younger generations are characterized by their strong commitment to social and environmental issues, often prioritizing impact over traditional financial returns. Research indicates that nearly 70% of Millennial investors express a desire to invest in companies that align with their values. This trend is reshaping the investment landscape, as financial institutions adapt their offerings to cater to the preferences of these socially conscious investors, thereby driving growth in the Impact Investing Market.

Regulatory Support and Policy Frameworks

The Impact Investing Market benefits from an evolving regulatory landscape that increasingly supports sustainable investment practices. Governments and regulatory bodies are implementing policies that encourage responsible investing, such as tax incentives for impact investments and guidelines for corporate social responsibility. For instance, several countries have introduced frameworks that promote transparency and accountability in impact measurement. This regulatory support not only enhances investor confidence but also fosters a conducive environment for the growth of the Impact Investing Market, potentially leading to increased capital flows into sustainable projects.

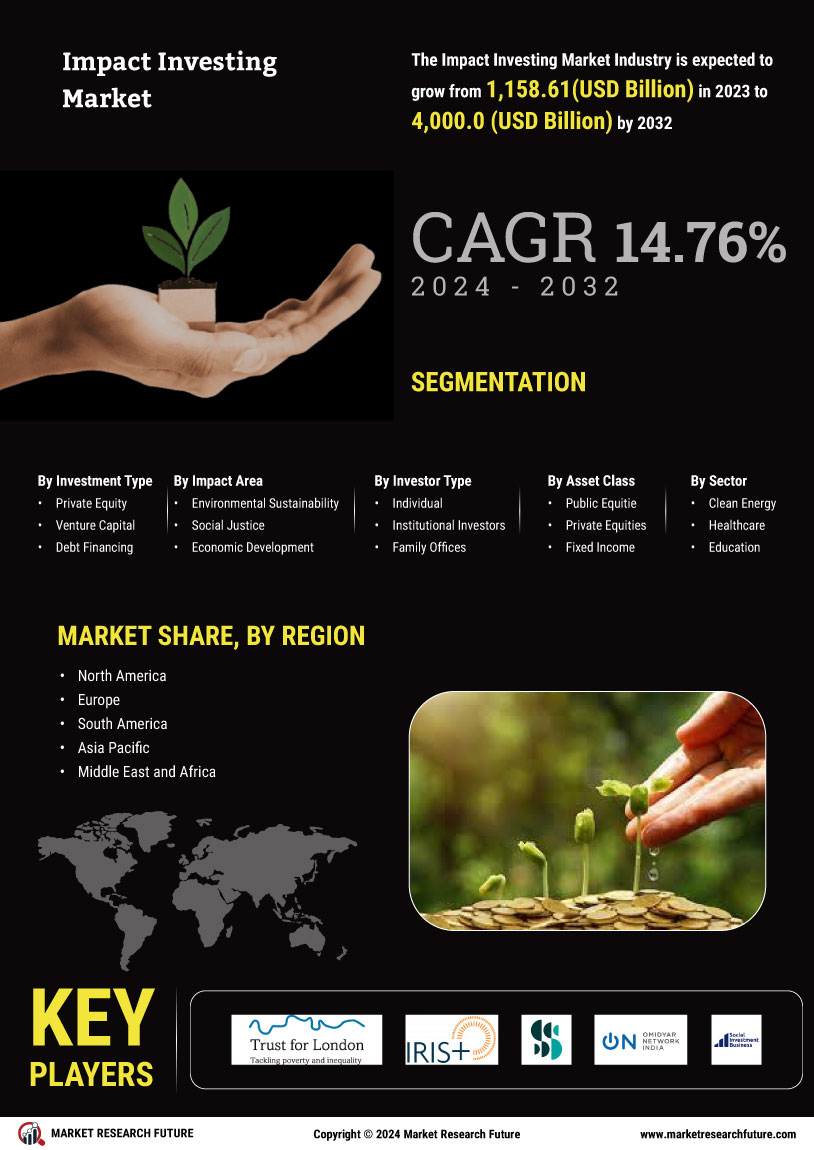

Growing Demand for Sustainable Investments

The Impact Investing Market is witnessing a notable increase in demand for sustainable investment options. Investors are increasingly seeking opportunities that align with their values, particularly in areas such as renewable energy, social equity, and environmental conservation. According to recent data, the market for sustainable investments has reached approximately 35 trillion USD, indicating a robust appetite for investments that yield both financial returns and positive social impact. This trend is likely to continue as more investors recognize the importance of sustainability in their portfolios, thereby driving growth in the Impact Investing Market.

Technological Advancements in Impact Measurement

Technological innovations are playing a pivotal role in the Impact Investing Market, particularly in the realm of impact measurement and reporting. Advanced analytics, artificial intelligence, and blockchain technology are being utilized to assess the social and environmental outcomes of investments more effectively. These tools enable investors to quantify their impact, thereby enhancing transparency and accountability. As a result, the ability to measure impact accurately is likely to attract more investors to the Impact Investing Market, as they seek to understand the tangible benefits of their investments.

Increased Collaboration Among Financial Institutions

Collaboration among various financial institutions is emerging as a key driver in the Impact Investing Market. Partnerships between banks, investment firms, and non-profit organizations are facilitating the pooling of resources and expertise to fund impactful projects. This collaborative approach not only enhances the scale of investments but also diversifies the types of financial products available to investors. As institutions recognize the potential for shared value creation, the Impact Investing Market is likely to see an influx of innovative investment vehicles that cater to a broader range of investors.