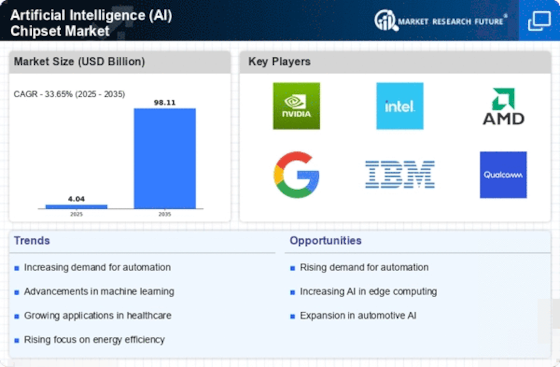

Leading market players are investing huge amounts in R&D to improve their product lines, which will assist the AI chipset industry to grow even more. Market participants are also undertaking multiple strategic activities to enhance their global footprint, with important market developments including new product launches, mergers and acquisitions, contractual agreements, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the artificial intelligence chipset industry must offer cost-effective items.Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global artificial intelligence (AI) chipset industry to benefit clients and increase the market sector. Major players in the artificial intelligence (AI) chipset market, including IBM Corporation (US), Micro Technology (US), Samsung Electronics Co. Ltd (South Korea), Advanced Micro Devices (US), Huawei Technologies Co. Ltd (China), and others, are attempting to increase market demand by investing in research and development operations.Intel Corp designs and develops technology products and components. The firm's product portfolio comprises microprocessors, chipsets, flash memory, graphic, network and communication, embedded processors and microcontrollers, and conferencing products. It also offers motherboards, solid-state drives, server products, wireless connectivity products and software and applications. Intel markets its products and solutions to industrial and communications equipment manufacturers, original equipment manufacturers, and original design manufacturers. The firm's products find applications in notebooks, servers, tablets and desktops. Intel markets processors under Core, Atom, Celeron, Quark, Pentium, Xeon, and Itanium brand names.

In March Intel collaborated with the Central Board of Secondary Education (CBSE), aiming to introduce the 'AI For All' initiative to create a basic understanding of artificial intelligence across various industry verticals in India.NVIDIA Corp is a designer and developer of graphics, central, and system-on-a-chip units. The company offers its products to gaming, professional visualization, data center, and automotive markets. It also delivers solutions for Artificial Intelligence and data science, design and visualization, data center and cloud computing, edge computing, high-performance computing, and self-driving vehicles. NVIDIA offers gamers, professional graphic designers, researchers, and developers products through GeForce NOW, Quadro, GeForce, SHIELD, vGPU, DOCA, JESTON, and Bluefield brand names.The company serves various sectors: architecture, engineering, construction, internet, cybersecurity, energy, financial services, healthcare and life sciences, education, gaming, manufacturing, media and entertainment, retail, robotics, telecommunication, and transportation.

In January Nvidia and AMD announced that the U.S. government had placed new restrictions to cut China and Russia off from high-end AI chips.