Rising Healthcare Expenditure

Rising healthcare expenditure is another significant driver of the Uterine Fibroid Market. As countries invest more in healthcare infrastructure and services, access to advanced medical treatments for uterine fibroids improves. Increased spending on healthcare is likely to facilitate the development and distribution of innovative therapies, including pharmaceuticals and surgical options. Market analysts project that this trend will continue, with healthcare expenditure expected to grow steadily in the coming years. This financial commitment to healthcare indicates a supportive environment for the Uterine Fibroid Market, fostering advancements in treatment options and improving patient access to necessary care.

Increased Focus on Women's Health

The heightened focus on women's health issues is driving growth in the Uterine Fibroid Market. As healthcare systems worldwide prioritize women's health, there is a growing recognition of the impact of uterine fibroids on quality of life. This increased attention has led to more funding for research and development of new treatments. Furthermore, educational campaigns aimed at raising awareness about uterine fibroids are becoming more prevalent, encouraging women to seek timely medical intervention. The Uterine Fibroid Market is poised to benefit from this trend, as more women become informed about their options and advocate for better healthcare solutions.

Rise in Uterine Fibroid Prevalence

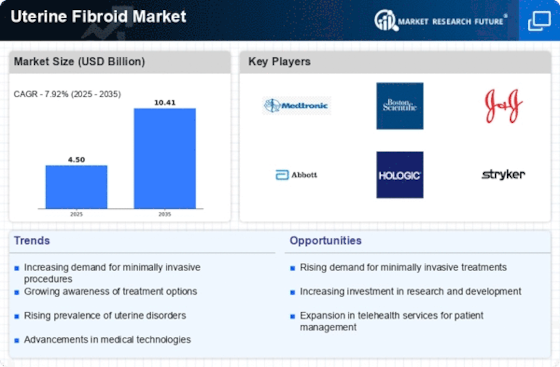

The increasing prevalence of uterine fibroids among women appears to be a primary driver for the Uterine Fibroid Market. Studies indicate that approximately 70 to 80% of women develop fibroids by the age of 50. This rising incidence is attributed to various factors, including hormonal changes and lifestyle choices. As awareness of fibroids grows, more women seek medical advice, leading to a surge in diagnostic procedures and treatment options. The Uterine Fibroid Market is likely to expand as healthcare providers enhance their focus on fibroid management, offering a range of therapies from medication to surgical interventions. This trend suggests a robust demand for innovative solutions tailored to the needs of affected women.

Advancements in Treatment Technologies

Technological advancements in the treatment of uterine fibroids are significantly influencing the Uterine Fibroid Market. Innovations such as laparoscopic myomectomy, uterine artery embolization, and MRI-guided focused ultrasound are gaining traction. These minimally invasive procedures not only reduce recovery time but also improve patient outcomes. The market for uterine fibroid treatments is projected to grow as these technologies become more widely adopted. According to recent estimates, the market could reach several billion dollars by the end of the decade, driven by the increasing availability of advanced treatment options. This evolution in treatment methodologies indicates a shift towards more patient-centric care in the Uterine Fibroid Market.

Growing Demand for Non-Invasive Procedures

The growing preference for non-invasive procedures is reshaping the Uterine Fibroid Market. Patients increasingly favor treatments that minimize surgical risks and recovery times. Non-invasive options, such as MRI-guided focused ultrasound and radiofrequency ablation, are becoming more popular due to their effectiveness and lower complication rates. Market data suggests that the demand for these procedures is expected to rise, as they offer a viable alternative to traditional surgical methods. This shift towards non-invasive treatments reflects a broader trend in healthcare, where patients seek less invasive solutions for managing their health conditions. Consequently, the Uterine Fibroid Market is likely to adapt to these changing preferences.