Top Industry Leaders in the USB Devices Market

The Ever-Evolving Landscape of USB Devices:

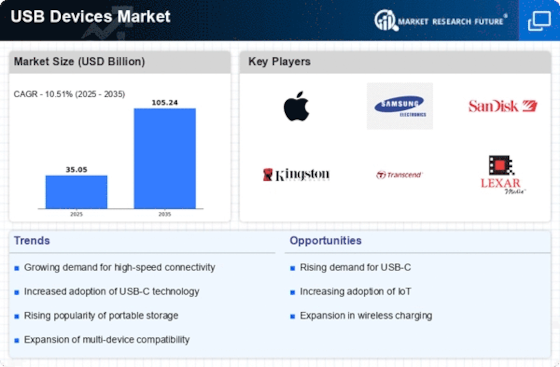

The ubiquitous USB device, despite its seemingly simple nature, occupies a dynamic and competitive market space. From the humble flash drive to sophisticated external hard drives and VR headsets, understanding the competitive landscape is crucial for both established and emerging players. This analysis delves into the strategies employed, key factors for market share analysis, the influx of new companies, and the overall competitive scenario within the USB device realm.

Some of the USB Devices companies listed below:

- Corsair Memory Inc.

- Adata Technology Co. Ltd.

- Sandisk Corporation

- Kingston Technology Corporation

- Toshiba Corporation

- Samsung Electronics Co. Ltd.

- Micron Consumer Products Group Inc.

- Verbatim Americas LLC

- Transcend Information Inc.

- Intel Corporation

- HP Inc.

- Imation Corporation (Ojin Corporation)

- Koninklijke Philips N.V.

- Netac Technology Co Ltd.

- Teclast Electronics Co. Ltd.

Strategies Adopted by Key Players:

- Innovation: Leading companies prioritize constant product upgrades, embracing faster data transfer speeds (USB 3.2 Gen 2 and beyond), increased storage capacities, and enhanced security features. Additionally, niche functionalities like wireless charging and integration with smart home ecosystems are being explored.

- Diversification: Major players like Samsung and SanDisk offer a wide range of USB devices catering to diverse user needs, from budget-friendly flash drives to high-performance external drives for professionals. This diversification mitigates risk and maximizes market reach.

- Branding: Establishing a strong brand identity plays a vital role. Companies like Kingston and Corsair leverage their reputation for reliability and performance to command premium pricing and attract loyal customer bases.

- Cost Optimization: Manufacturers in emerging economies like China and India benefit from lower production costs, enabling them to offer competitive pricing and threaten established brands' market share.

- Strategic Partnerships: Collaborations with technology giants like Apple and Microsoft for device compatibility and exclusive features can significantly boost brand recognition and sales.

Market Share Analysis:

- Market Segmentation: Analyzing market share based on device type (flash drives, external hard drives, etc.), capacity, price range, and target audience (consumer, professional) provides a nuanced understanding of the competitive landscape.

- Regional Variations: Market share distribution varies significantly across regions. Asia dominates the production and consumption of USB devices due to lower manufacturing costs and a large consumer base. Europe and North America, while having smaller production volumes, prioritize higher-end products and niche markets.

- Online vs. Offline Sales: E-commerce platforms like Amazon and Alibaba play a crucial role in driving sales, particularly for budget-conscious consumers. However, brick-and-mortar stores remain relevant for impulse purchases and personalized customer service.

- Brand Loyalty: Established brands with strong reputations often command higher market share due to customer trust and brand recognition. However, new entrants with innovative offerings can disrupt the market and gain traction quickly.

New and Emerging Companies:

- Start-ups: Innovative start-ups are pushing boundaries with unique features like bio-metric security on flash drives, self-encrypting hard drives, and portable solar-powered charging solutions. These niche offerings cater to specific user needs and can create new market segments.

- Direct-to-Consumer Brands: Online-only brands leveraging social media marketing and influencer partnerships are challenging traditional distribution channels. They offer competitive pricing and cater to tech-savvy consumers seeking value and convenience.

- Crowdfunding: Platforms like Kickstarter and Indiegogo enable innovative USB device concepts to gain traction and secure funding directly from consumers. This bypasses traditional funding hurdles and allows for quicker market entry for promising new ideas.

Latest Company Updates:

On Nov .09, 2023- Ossia announced a new adaptor that can deliver power wirelessly to any USB-powered device, including tablets, Bluetooth speakers, game controllers, and smart-home IoT devices requiring low-power charging. The system is based on a patented, FCC-approved technology called Cota Real Wireless Power that transmits power over a distance of up to 30 feet. The Cota Hub could be a game changer for power distribution.

On Oct.02, 2023- RevBits announced that it has strengthened its already robust USB device policy environment in its endpoint security & EDR solution by adding a defining field for device serial numbers. In addition to its strength in detecting and blocking malware, RevBits EPS & EDR removes the threat landscape of malicious acts delivered through USB devices. The solution's EDR module provides total forensics and endpoint mitigation features and a US-patented technology for protecting the kernel through its anti-rootkit function.

On Oct.09, 2023- Electronic Team, Inc., a software development company, announced a new cost-effective pricing offer for USB Network Gate, enabling customers to share USB devices over a network to increase productivity and reduce equipment costs. USB Network Gate's pricing has changed significantly to provide exceptional value along with the solution's innovative technology.

This new pricing offer provides cost savings and is intended to encourage more businesses to take advantage of the functionality available with USB Network Gate. Companies can benefit substantially from sharing USB devices over the network with no distance limitations.