Market Analysis

In-depth Analysis of USB Devices Market Industry Landscape

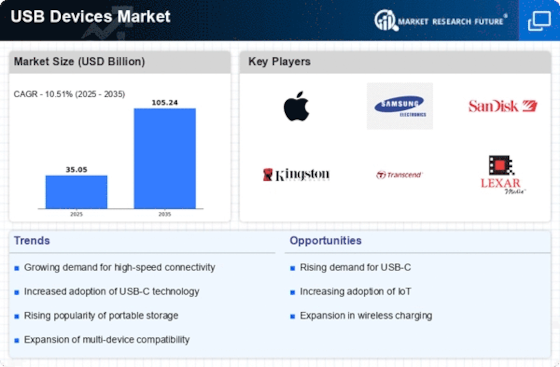

The dynamics of the USB device industry have changed significantly in recent years, reflecting how consumer preferences and technology are always changing. In contemporary computing, USB (Universal Serial Bus) devices are commonplace because they provide a standardized interface for attaching a variety of peripherals and gadgets to computers and other devices. A number of significant elements impact the dynamics of the USB device industry. Developments in technology have a significant impact on the market for USB devices. The market reacts to the introduction of new generations of USB standards, such USB 3.0, USB 3.1, and USB 3.2, by driving up demand for products that are compliant. These developments meet the expanding need for power delivery capabilities in addition to accelerating data transfer speeds. Businesses and consumers alike are looking for quicker and more effective connection solutions, and market dynamics are strongly correlated with the rate of technical innovation.

Furthermore, alterations in consumer choices and lifestyle have a substantial impact on market dynamics. The growing need for small and multipurpose USB peripherals is a result of people's increased reliance on portable electronics like laptops, tablets, and smartphones. The most sought-after items in this category include charging cords, USB flash drives, and external hard drives. Market trends change as a result of manufacturers creating USB devices that satisfy consumers' growing need for portability and ease. The market stability and reliability of USB devices are facilitated by industry certifications and regulatory requirements. Adherence to USB standards guarantees compatibility and interoperability, giving customers peace of mind that gadgets made by various manufacturers will operate together without any issues. Furthermore, upholding safety and quality standards fosters customer trust and influences their purchase decisions. Standards adherence has become a critical differentiator for producers, meaning that the regulatory environment shapes market dynamics in addition to customer preferences.

Leave a Comment