Regulatory Support and Incentives

The variable speed-generator market is significantly influenced by regulatory frameworks and incentives established by government bodies. In the US, various policies promote the adoption of advanced generator technologies, including variable speed systems. These regulations often include tax credits, grants, and rebates aimed at encouraging businesses to invest in cleaner and more efficient energy solutions. For instance, the federal government has allocated substantial funding to support renewable energy projects, which indirectly boosts the variable speed-generator market. As compliance with environmental standards becomes increasingly critical, the market is likely to see continued growth fueled by supportive regulatory measures.

Growing Demand for Energy Efficiency

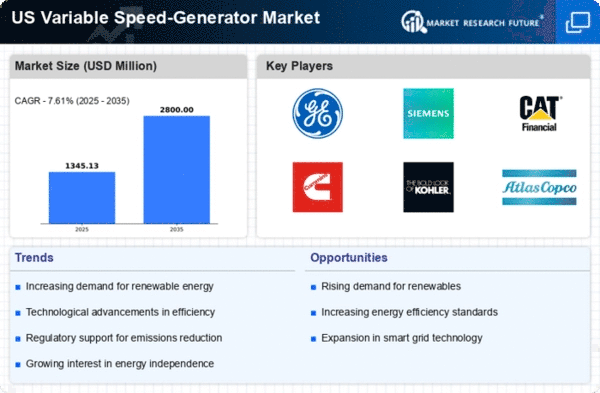

The variable speed-generator market is experiencing a notable surge in demand driven by the increasing emphasis on energy efficiency across various sectors. Industries are actively seeking solutions that minimize energy consumption while maximizing output. This trend is particularly evident in manufacturing and commercial sectors, where energy costs represent a significant portion of operational expenses. According to recent data, energy-efficient technologies can reduce energy consumption by up to 30%. As organizations strive to lower their carbon footprints and comply with stringent regulations, the variable speed-generator market is positioned to benefit from this shift towards energy-efficient solutions.

Increased Focus on Backup Power Solutions

the variable speed-generator market is witnessing a focus on backup power solutions, particularly in critical sectors such as healthcare, data centers, and telecommunications. The need for reliable power supply during outages has prompted businesses to invest in advanced generator systems that offer flexibility and efficiency. Variable speed generators are particularly appealing due to their ability to operate at varying loads, which can lead to reduced fuel consumption and lower operational costs. As the demand for uninterrupted power supply continues to rise, the variable speed-generator market is likely to see substantial growth, with an estimated increase in market size of 20% by 2027.

Rising Adoption of Smart Grid Technologies

The integration of smart grid technologies is reshaping the landscape of the variable speed-generator market. Smart grids facilitate real-time monitoring and management of energy resources, enhancing the efficiency and reliability of power generation. The deployment of these technologies allows for better integration of variable speed generators, which can adjust their output based on demand fluctuations. As the US grid infrastructure evolves, the variable speed-generator market is expected to expand, with projections indicating a potential market growth of 15% annually over the next five years. This trend underscores the importance of adaptability in energy generation.

Technological Innovations in Generator Design

Technological innovations are playing a pivotal role in shaping the variable speed-generator market. Advances in materials, control systems, and design methodologies are leading to the development of more efficient and reliable generators. These innovations not only enhance performance but also reduce maintenance costs and extend the lifespan of the equipment. For instance, the introduction of advanced electronic controls allows for precise management of generator output, optimizing fuel efficiency. As manufacturers continue to invest in research and development, the variable speed-generator market is expected to benefit from these advancements, potentially increasing market penetration by 25% over the next few years.