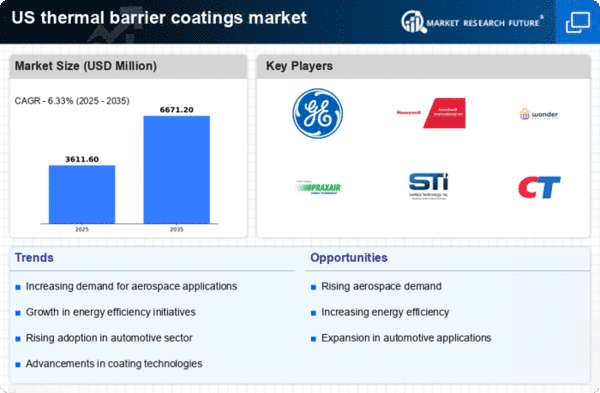

The thermal barrier-coatings market is characterized by a competitive landscape that is increasingly shaped by innovation, strategic partnerships, and a focus on sustainability. Key players such as General Electric (US), Honeywell International (US), and Praxair Surface Technologies (US) are at the forefront of this dynamic environment. General Electric (US) emphasizes technological advancements in coating materials, aiming to enhance performance in aerospace applications. Meanwhile, Honeywell International (US) is leveraging its expertise in digital transformation to optimize manufacturing processes and improve product offerings. Praxair Surface Technologies (US) focuses on expanding its service capabilities, particularly in the energy sector, which is indicative of a broader trend towards specialization and tailored solutions in the market.The business tactics employed by these companies reflect a concerted effort to localize manufacturing and optimize supply chains, which is crucial in a moderately fragmented market. This competitive structure allows for a diverse range of offerings, yet the influence of major players remains significant. Their strategies not only enhance operational efficiency but also contribute to a more resilient supply chain, which is increasingly vital in today's economic climate.

In October General Electric (US) announced a partnership with a leading aerospace manufacturer to develop next-generation thermal barrier coatings aimed at improving fuel efficiency in jet engines. This collaboration is expected to leverage advanced materials science, potentially setting new benchmarks in performance and sustainability. The strategic importance of this partnership lies in its alignment with the industry's shift towards greener technologies, which is becoming a critical factor in competitive differentiation.

In September Honeywell International (US) launched a new line of thermal barrier coatings designed specifically for high-temperature applications in industrial gas turbines. This product introduction not only showcases Honeywell's commitment to innovation but also reflects a growing demand for high-performance materials that can withstand extreme conditions. The strategic significance of this move is underscored by the increasing focus on energy efficiency and reduced emissions in industrial operations.

In August Praxair Surface Technologies (US) expanded its manufacturing capabilities by investing in a new facility dedicated to the production of advanced thermal barrier coatings. This investment is indicative of the company's strategy to enhance its market presence and meet the rising demand for specialized coatings in various sectors, including aerospace and power generation. The expansion is likely to bolster Praxair's competitive position by enabling faster delivery times and improved service levels.

As of November the competitive trends in the thermal barrier-coatings market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are playing a pivotal role in shaping the landscape, as companies seek to combine resources and expertise to drive innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to evolving market demands.