Growing Urbanization

The Global Barrier Systems Market Industry is significantly impacted by the ongoing trend of urbanization, which is driving the need for enhanced safety measures in densely populated areas. As cities expand, the risk of accidents and security breaches increases, prompting the installation of barrier systems in public spaces, residential areas, and commercial zones. This demand is reflected in the anticipated growth of the market, which is expected to reach 12.3 USD Billion by 2035. Urban planners and policymakers are increasingly recognizing the importance of barrier systems in creating safer environments, thereby contributing to the industry's expansion.

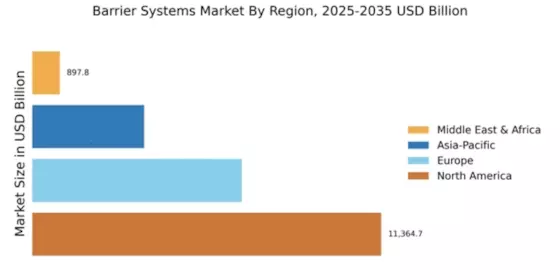

Market Growth Projections

The Global Barrier Systems Market Industry is poised for substantial growth, with projections indicating a market size of 7.16 USD Billion in 2024 and an anticipated increase to 12.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.04% from 2025 to 2035, reflecting the increasing demand for barrier systems across various sectors. Factors contributing to this growth include infrastructure investments, safety regulations, and technological advancements. The market's expansion is indicative of a broader recognition of the importance of barrier systems in enhancing safety and security globally.

Rising Safety Regulations

The Global Barrier Systems Market Industry is influenced significantly by the introduction of stringent safety regulations across multiple sectors. Regulatory bodies are mandating the installation of barrier systems to mitigate risks associated with vehicular accidents and unauthorized access. For example, the implementation of these regulations in transportation and construction sectors has led to a notable increase in demand for advanced barrier technologies. As safety standards evolve, the market is likely to expand, with projections indicating a growth to 12.3 USD Billion by 2035. This trend underscores the critical role of compliance in driving market dynamics.

Technological Advancements

The Global Barrier Systems Market Industry is benefiting from rapid technological advancements that enhance the effectiveness and efficiency of barrier systems. Innovations such as smart barriers, which utilize sensors and automation, are becoming increasingly prevalent. These technologies not only improve safety but also offer real-time monitoring capabilities, appealing to sectors such as transportation and event management. The integration of advanced materials and designs is expected to further propel market growth, as stakeholders seek solutions that provide both durability and functionality. This trend aligns with the projected CAGR of 5.04% from 2025 to 2035, indicating a robust future for the industry.

Increasing Infrastructure Investments

The Global Barrier Systems Market Industry is experiencing a surge in demand due to heightened investments in infrastructure development across various regions. Governments are prioritizing the construction of roads, bridges, and tunnels, which necessitate the implementation of effective barrier systems to enhance safety and security. For instance, the global infrastructure spending is projected to reach approximately 7.16 USD Billion in 2024, reflecting a growing recognition of the importance of protective measures in public works. As urbanization accelerates, the need for robust barrier systems becomes increasingly evident, indicating a strong growth trajectory for the industry.

Environmental Concerns and Sustainability

The Global Barrier Systems Market Industry is increasingly shaped by environmental concerns and the push for sustainable practices. As awareness of ecological impacts grows, there is a shift towards barrier systems that utilize eco-friendly materials and designs. This trend is particularly relevant in construction and transportation sectors, where sustainable solutions are becoming a priority. The integration of green technologies not only addresses environmental issues but also meets the demands of regulatory frameworks aimed at reducing carbon footprints. Consequently, this focus on sustainability is likely to drive innovation and growth within the industry.