Rise in IoT Applications

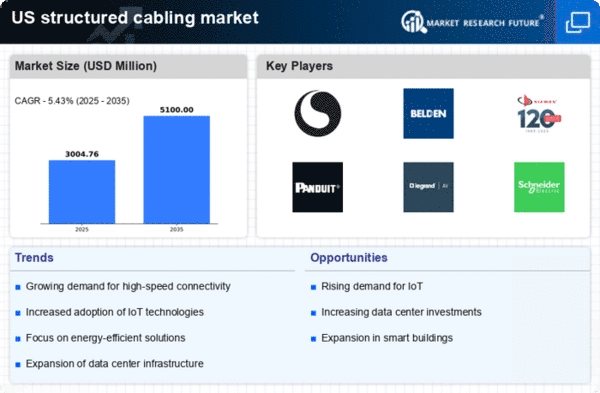

The proliferation of Internet of Things (IoT) applications is driving the structured cabling market in the US. With an increasing number of devices connected to the internet, the demand for reliable and high-speed cabling solutions is paramount. In 2025, it is estimated that there will be over 30 billion connected devices globally, with a significant portion located in the US. This growth necessitates the implementation of structured cabling systems that can handle the increased data traffic and ensure efficient communication between devices. Moreover, as industries such as healthcare, manufacturing, and smart cities adopt IoT technologies, the structured cabling market is likely to experience heightened demand for innovative cabling solutions that support these applications.

Expansion of Data Centers

The expansion of data centers in the US is a pivotal driver for the structured cabling market. As businesses increasingly rely on cloud computing and data storage solutions, the demand for robust cabling infrastructure intensifies. In 2025, the data center market is projected to reach approximately $200 billion, indicating a substantial growth trajectory. This surge necessitates advanced structured cabling systems to support high data transfer rates and ensure reliable connectivity. Furthermore, the need for efficient cooling and power management in data centers further emphasizes the importance of structured cabling solutions. As organizations seek to optimize their operations, the structured cabling market stands to benefit significantly from this trend, as it provides the backbone for the seamless functioning of data centers across various sectors.

Growth of Smart Buildings

The trend towards smart buildings is significantly influencing the structured cabling market. As more commercial and residential properties integrate smart technologies, the need for advanced cabling infrastructure becomes critical. In 2025, the smart building market is projected to reach $100 billion in the US, highlighting the increasing investment in intelligent systems. Structured cabling plays a vital role in enabling the connectivity of various smart devices, such as lighting, HVAC, and security systems. This integration not only enhances energy efficiency but also improves occupant comfort and safety. Consequently, the structured cabling market is poised for growth as building owners and developers prioritize the installation of sophisticated cabling solutions to support the demands of smart building technologies.

Increased Focus on Network Security

As cyber threats continue to evolve, the emphasis on network security is becoming a crucial driver for the structured cabling market. Organizations in the US are increasingly investing in secure cabling solutions to protect sensitive data and maintain operational integrity. In 2025, the cybersecurity market is expected to exceed $300 billion, reflecting the growing awareness of the importance of safeguarding information. Structured cabling systems are integral to establishing secure networks, as they facilitate the implementation of advanced security protocols and technologies. This heightened focus on security is likely to propel the demand for structured cabling solutions that can support robust security measures, thereby enhancing the overall resilience of organizational networks.

Regulatory Compliance and Standards

Regulatory compliance and adherence to industry standards are essential drivers for the structured cabling market. In the US, various regulations govern the installation and maintenance of cabling systems, ensuring safety and performance. As organizations strive to meet these compliance requirements, the demand for high-quality structured cabling solutions increases. In 2025, it is anticipated that the market for compliance-related services will grow significantly, as businesses prioritize investments in infrastructure that meets regulatory standards. This trend not only enhances the reliability of cabling systems but also mitigates risks associated with non-compliance. Consequently, the structured cabling market is likely to benefit from the ongoing emphasis on regulatory adherence, as organizations seek to implement compliant cabling solutions.