Expansion of Data Centres

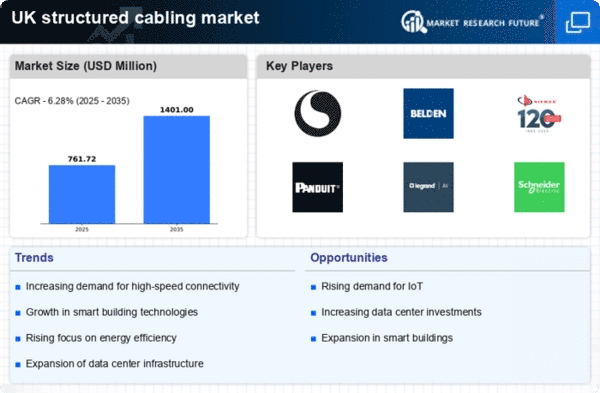

The rapid expansion of data centres in the UK is a primary driver for the structured cabling market. As businesses increasingly rely on data-driven operations, the demand for efficient and reliable cabling solutions has surged. In 2025, the UK data centre market is projected to reach a value of £4 billion, indicating a robust growth trajectory. This expansion necessitates advanced structured cabling systems to support high data transfer rates and connectivity. Furthermore, the need for scalability in data centres compels operators to invest in flexible cabling solutions that can adapt to evolving technological requirements. Consequently, the structured cabling market is likely to benefit from this trend, as companies seek to enhance their infrastructure to accommodate growing data needs.

Emergence of IoT Applications

The emergence of Internet of Things (IoT) applications in various sectors is driving demand for structured cabling solutions in the UK. As more devices become interconnected, the need for reliable and efficient cabling systems becomes paramount. The IoT market in the UK is projected to grow by 40% by 2026, indicating a significant shift towards connected devices in industries such as healthcare, manufacturing, and smart cities. This trend suggests that the structured cabling market will need to adapt to support the increased data traffic generated by IoT devices. Companies are likely to invest in advanced cabling solutions that can accommodate the unique requirements of IoT applications, thereby fostering growth in the structured cabling market.

Growing Need for Network Security

As cyber threats continue to evolve, the growing need for network security is becoming a significant driver for the structured cabling market. Businesses in the UK are increasingly aware of the vulnerabilities associated with outdated cabling systems, which can compromise data integrity and security. In 2025, it is estimated that the cybersecurity market in the UK will reach £8 billion, reflecting a strong emphasis on protecting sensitive information. This heightened focus on security is likely to lead organizations to invest in modern structured cabling solutions that incorporate advanced security features. Consequently, the structured cabling market may experience growth as companies seek to enhance their network security posture through improved cabling infrastructure.

Rise in Smart Building Initiatives

The increasing focus on smart building initiatives in the UK is significantly influencing the structured cabling market. Smart buildings, which integrate advanced technologies for improved energy efficiency and occupant comfort, require sophisticated cabling systems to support various applications. The UK government has set ambitious targets for energy efficiency, which may drive the adoption of smart technologies in commercial and residential buildings. As of 2025, it is estimated that the smart building market in the UK will grow by approximately 30%, creating a substantial demand for structured cabling solutions. This trend suggests that the structured cabling market will play a crucial role in facilitating the connectivity required for smart technologies, thereby enhancing overall building performance.

Increased Investment in Telecommunications Infrastructure

The UK government and private sector are making substantial investments in telecommunications infrastructure, which is a key driver for the structured cabling market. With the ongoing rollout of 5G networks, there is a heightened need for robust cabling systems that can support high-speed data transmission. The UK telecommunications market is expected to grow by 25% by 2026, driven by the demand for faster and more reliable connectivity. This investment not only enhances consumer access to high-speed internet but also stimulates the structured cabling market as businesses upgrade their infrastructure to meet new standards. The integration of advanced cabling solutions is essential for ensuring that the telecommunications infrastructure can handle increased data loads and connectivity demands.