Expansion of Smart Cities

Japan's commitment to developing smart cities is a crucial factor propelling the structured cabling market. As urban areas increasingly integrate technology to enhance infrastructure and services, the need for reliable cabling systems becomes paramount. The structured cabling market is expected to benefit from investments in smart city projects, which often require extensive cabling networks to support various applications, including traffic management, public safety, and energy efficiency. The Japanese government has allocated substantial funding for these initiatives, indicating a strong focus on modernizing urban infrastructure. This trend not only enhances the quality of life for residents but also creates a substantial opportunity for the structured cabling market to grow, as it provides the necessary backbone for smart technologies.

Emergence of Remote Work Trends

The shift towards remote work in Japan has emerged as a notable driver for the structured cabling market. As organizations adapt to flexible work arrangements, there is an increasing need for reliable home office setups that can support high-speed internet and seamless connectivity. This trend has led to a surge in demand for structured cabling solutions that facilitate efficient data transfer and communication. The structured cabling market is likely to see growth as businesses invest in infrastructure that enables remote work capabilities, ensuring employees have access to the necessary tools and resources. Furthermore, the emphasis on maintaining productivity and collaboration in a remote environment underscores the importance of robust cabling systems, thereby positively influencing the structured cabling market.

Increased Focus on Data Security

With the rise in cyber threats, the emphasis on data security has become a significant driver for the structured cabling market. Organizations in Japan are increasingly aware of the vulnerabilities associated with outdated cabling systems, which can compromise data integrity and security. As a result, there is a growing trend towards upgrading to more secure and efficient cabling solutions. The structured cabling market is likely to see a surge in demand as businesses invest in infrastructure that not only supports high-speed connectivity but also enhances security measures. This shift is particularly relevant in sectors such as finance and healthcare, where data protection is critical. Consequently, the increased focus on data security is expected to positively impact the structured cabling market.

Growth of the Telecommunications Sector

The telecommunications sector in Japan is experiencing robust growth, which serves as a vital driver for the structured cabling market. As telecom companies expand their networks to accommodate the rising demand for mobile and internet services, the need for efficient cabling solutions becomes increasingly apparent. The structured cabling market is projected to benefit from the rollout of 5G technology, which requires advanced cabling infrastructure to support higher data rates and connectivity. Investments in telecommunications infrastructure are expected to reach approximately $10 billion by 2026, further stimulating the structured cabling market. This growth not only enhances connectivity for consumers but also creates opportunities for businesses to leverage advanced technologies, thereby driving the demand for structured cabling solutions.

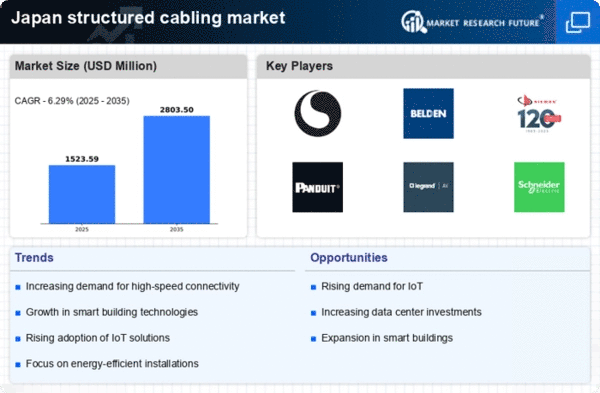

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed internet and data transfer capabilities is a primary driver for the structured cabling market. As businesses and consumers in Japan seek faster and more reliable connectivity, the need for advanced cabling solutions becomes evident. The structured cabling market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, driven by the proliferation of IoT devices and smart technologies. This trend necessitates the installation of robust cabling systems that can support high bandwidth and low latency. Furthermore, the expansion of data centers and cloud services in Japan further fuels this demand, as organizations require efficient cabling infrastructure to manage their data traffic effectively. Thus, the rising demand for high-speed connectivity significantly influences the structured cabling market.