Increasing Health Consciousness

The growing awareness of health and wellness among consumers is driving the potato starch market. As individuals seek healthier food options, the demand for clean-label products has surged. Potato starch, being a natural ingredient, aligns well with this trend. In the US, the market for clean-label food products is projected to reach $180 billion by 2025, indicating a robust growth trajectory. This shift towards healthier eating habits is likely to propel the potato starch market, as manufacturers increasingly incorporate it into their formulations to enhance texture and stability without compromising on health benefits. Furthermore, the potato starch market is expected to benefit from the rising preference for gluten-free and allergen-free products, as potato starch serves as an excellent alternative to wheat-based thickeners.

Expansion of the Snack Food Sector

The snack food sector in the US is experiencing rapid growth, which is positively influencing the potato starch market. As consumers increasingly opt for convenient and on-the-go food options, manufacturers are incorporating potato starch into various snack products for its binding and textural properties. The snack food market is projected to reach $100 billion by 2025, with potato starch playing a crucial role in enhancing the quality and appeal of these products. The potato starch market is likely to benefit from this trend, as it provides a versatile ingredient that can improve the mouthfeel and shelf-life of snacks. Additionally, the rise of healthier snack alternatives is further propelling the demand for potato starch, as it is perceived as a natural and healthier option compared to synthetic additives.

Increased Use in Industrial Applications

The potato starch market is witnessing a notable increase in demand from industrial applications, particularly in the paper and textile industries. Potato starch is utilized as a binding agent and thickener, enhancing the quality of products in these sectors. The paper industry, for instance, is projected to grow at a CAGR of 3.2% through 2025, which could lead to increased consumption of potato starch as manufacturers seek to improve the performance of their products. The potato starch market is also benefiting from the rising trend of sustainable practices, as potato starch is biodegradable and environmentally friendly. This shift towards eco-conscious materials is likely to drive further growth in the industrial sector, presenting new opportunities for potato starch applications beyond traditional food uses.

Technological Advancements in Processing

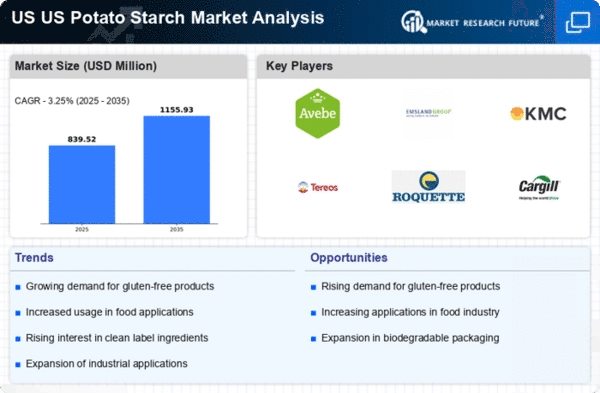

Innovations in processing technologies are significantly impacting the potato starch market. Advanced extraction and purification methods have improved the quality and yield of potato starch, making it more appealing to manufacturers. For instance, the introduction of enzymatic processes has enhanced the efficiency of starch extraction, resulting in higher purity levels. This is particularly relevant in the food sector, where the demand for high-quality ingredients is paramount. The potato starch market is witnessing a shift towards more sustainable practices, with companies investing in eco-friendly processing techniques. As a result, the market is expected to grow at a CAGR of 4.5% from 2025 to 2030, driven by these technological advancements that not only improve product quality but also reduce environmental impact.

Rising Demand for Plant-Based Ingredients

The increasing consumer preference for plant-based diets is significantly impacting the potato starch market. As more individuals adopt vegetarian and vegan lifestyles, the demand for plant-derived ingredients has surged. Potato starch, being a plant-based product, is well-positioned to meet this growing demand. The plant-based food market in the US is expected to reach $74 billion by 2027, indicating a substantial opportunity for the potato starch market. This trend is further supported by the rising awareness of the environmental benefits associated with plant-based diets. Consequently, manufacturers are increasingly incorporating potato starch into their formulations to cater to this demographic, enhancing the market's growth potential. The versatility of potato starch in various applications, from food to non-food products, makes it a valuable ingredient in the expanding plant-based sector.