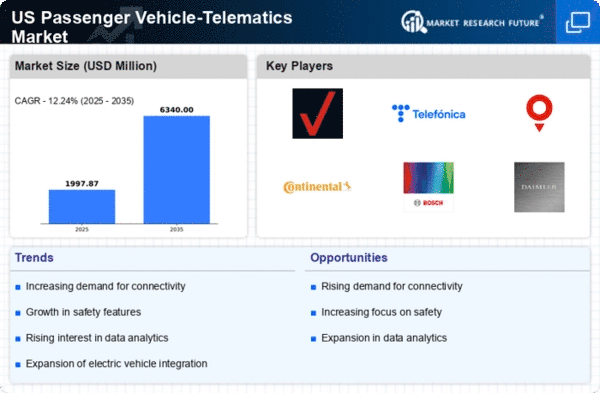

Rising Demand for Connectivity

The increasing consumer demand for connectivity in vehicles is a primary driver of the passenger vehicle-telematics market. As technology advances, consumers expect seamless integration of their mobile devices with their vehicles. This trend is reflected in the growing adoption of infotainment systems, which are projected to reach a market value of $20 billion by 2026. The desire for real-time information, navigation, and entertainment options is pushing manufacturers to incorporate advanced telematics solutions. Consequently, the passenger vehicle-telematics market is experiencing a surge in demand for features that enhance connectivity, such as smartphone integration and cloud-based services. This shift not only improves user experience but also encourages manufacturers to innovate, thereby expanding the market further.

Growth of Fleet Management Solutions

Fleet management solutions are a notable driver of the passenger vehicle-telematics market. Businesses are increasingly recognizing the value of telematics in optimizing fleet operations, enhancing efficiency, and reducing costs. The market for fleet management is expected to reach $34 billion by 2025, indicating a robust growth trajectory. Telematics systems provide real-time tracking, vehicle diagnostics, and driver behavior analysis, which are essential for effective fleet management. This trend is particularly relevant for logistics and transportation companies, which rely heavily on telematics to improve operational efficiency. Consequently, the passenger vehicle-telematics market is benefiting from the rising demand for advanced fleet management solutions, which are becoming integral to business operations.

Government Regulations and Safety Standards

Government regulations and safety standards are significantly influencing the passenger vehicle-telematics market. In the US, regulatory bodies are increasingly mandating the inclusion of telematics systems in new vehicles to enhance safety and reduce accidents. For instance, the National Highway Traffic Safety Administration (NHTSA) has proposed regulations that require vehicle-to-vehicle communication systems, which are expected to improve road safety. This regulatory push is likely to drive the adoption of telematics solutions, as manufacturers must comply with these standards. The market is projected to grow at a CAGR of 15% over the next five years, driven by these regulatory requirements. As a result, the passenger vehicle-telematics market is positioned to expand as manufacturers invest in compliant technologies.

Consumer Preference for Enhanced Safety Features

Consumer preference for enhanced safety features is a critical driver of the passenger vehicle-telematics market. As awareness of road safety increases, consumers are actively seeking vehicles equipped with advanced safety technologies. Features such as collision avoidance systems, lane departure warnings, and emergency braking are becoming standard expectations. This shift is reflected in market data, which indicates that vehicles with advanced safety features can command a premium of up to 10% over those without. Manufacturers are responding to this demand by integrating telematics solutions that support these safety features, thereby driving growth in the passenger vehicle-telematics market. The emphasis on safety is likely to continue influencing consumer purchasing decisions, further propelling market expansion.

Technological Advancements in Telematics Solutions

Technological advancements in telematics solutions are propelling the growth of the passenger vehicle-telematics market. Innovations such as artificial intelligence, machine learning, and big data analytics are enhancing the capabilities of telematics systems. These technologies enable more accurate data collection and analysis, leading to improved vehicle performance and user experience. For instance, predictive maintenance powered by AI can reduce vehicle downtime by up to 30%, which is appealing to both consumers and fleet operators. As these technologies evolve, they are likely to create new opportunities within the passenger vehicle-telematics market, encouraging manufacturers to adopt cutting-edge solutions. This continuous innovation is expected to sustain market growth as stakeholders seek to leverage the latest advancements.