Growing Emphasis on Fuel Efficiency

The growing emphasis on fuel efficiency serves as a critical driver in the Off-Highway Vehicle Telematics Market. With rising fuel costs and environmental concerns, operators are increasingly seeking solutions that enhance fuel management. Telematics systems provide valuable insights into fuel consumption patterns, enabling companies to implement strategies that reduce waste and improve efficiency. Reports indicate that telematics can lead to fuel savings of up to 20%, which is particularly appealing in sectors like mining and construction where fuel expenses constitute a significant portion of operational costs. As regulations around emissions become stricter, the demand for telematics solutions that promote fuel efficiency is likely to increase, further propelling market growth.

Integration of Advanced GPS Technology

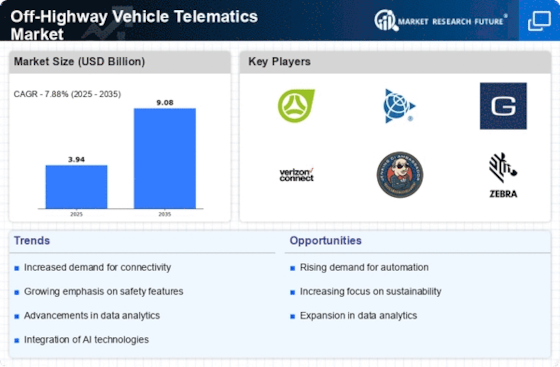

The integration of advanced GPS technology is a pivotal driver in the Off-Highway Vehicle Telematics Market. This technology enhances the precision of location tracking, enabling operators to monitor vehicle movements in real-time. As a result, companies can optimize their fleet management, reduce operational costs, and improve overall efficiency. The market for GPS-enabled telematics solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This growth is largely attributed to the increasing need for accurate navigation and tracking in off-highway applications, such as construction and agriculture. Furthermore, the ability to analyze location data allows for better decision-making and resource allocation, which is crucial in competitive industries.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Off-Highway Vehicle Telematics Market. Governments worldwide are implementing stringent regulations aimed at enhancing safety and reducing environmental impact. Telematics solutions assist companies in adhering to these regulations by providing data that supports compliance efforts. For instance, telematics can track vehicle emissions and monitor operator behavior, ensuring that safety protocols are followed. The market for telematics solutions that focus on compliance is projected to expand, as businesses recognize the importance of meeting regulatory requirements to avoid penalties and enhance their reputation. This trend is likely to drive innovation in telematics technologies, further shaping the industry landscape.

Rising Demand for Real-Time Data Analytics

The rising demand for real-time data analytics is a significant driver in the Off-Highway Vehicle Telematics Market. As industries become more data-driven, the need for actionable insights from telematics data is growing. Real-time analytics enable operators to make informed decisions quickly, enhancing operational efficiency and responsiveness. The ability to analyze data on vehicle performance, fuel consumption, and driver behavior in real-time can lead to improved productivity and cost savings. Market forecasts indicate that the demand for data analytics in telematics will continue to rise, with many companies investing in advanced analytics capabilities. This trend not only supports better decision-making but also fosters a culture of continuous improvement within organizations.

Enhanced Maintenance and Downtime Management

Enhanced maintenance and downtime management is emerging as a vital driver in the Off-Highway Vehicle Telematics Market. Telematics systems facilitate predictive maintenance by providing real-time data on vehicle performance and health. This capability allows operators to identify potential issues before they escalate, thereby minimizing unplanned downtime. Studies suggest that companies utilizing telematics for maintenance can reduce equipment downtime by as much as 30%. This is particularly beneficial in industries such as agriculture and construction, where equipment availability is crucial for productivity. As businesses strive to maximize asset utilization, the adoption of telematics solutions for maintenance management is expected to rise, contributing to the overall growth of the market.