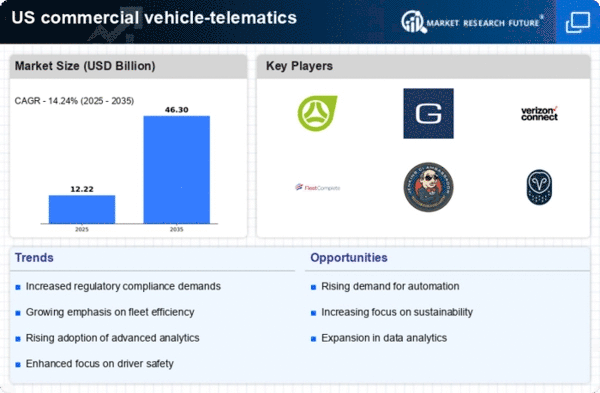

Growing Focus on Sustainability

The growing focus on sustainability is a pivotal driver for the commercial vehicle-telematics market. As environmental concerns gain prominence, fleet operators are increasingly adopting telematics solutions to monitor and reduce their carbon footprint. By optimizing routes and improving fuel efficiency, telematics can contribute to lower emissions. Recent studies indicate that fleets utilizing telematics can reduce greenhouse gas emissions by up to 10%. This alignment with sustainability goals not only enhances corporate responsibility but also appeals to environmentally conscious consumers. Consequently, the commercial vehicle-telematics market is likely to see increased adoption as companies strive to meet sustainability targets.

Integration of Advanced Analytics

The integration of advanced analytics into telematics systems reshapes the commercial vehicle-telematics market. Companies are leveraging big data analytics to gain insights into vehicle performance, driver behavior, and operational efficiency. This data-driven approach enables fleet managers to make informed decisions that enhance productivity and reduce costs. For instance, predictive analytics can forecast maintenance needs, minimizing unexpected breakdowns and associated costs. As businesses recognize the value of data in optimizing operations, the demand for telematics solutions that incorporate advanced analytics is expected to rise. This trend indicates a promising future for the commercial vehicle-telematics market.

Rising Demand for Fleet Efficiency

The commercial vehicle-telematics market is experiencing a notable surge in demand for enhanced fleet efficiency. Companies are increasingly seeking solutions that optimize routes, reduce fuel consumption, and improve overall operational performance. According to recent data, businesses utilizing telematics solutions can achieve fuel savings of up to 15%. This drive for efficiency is not merely a trend but a necessity, as operational costs continue to rise. The integration of telematics systems allows fleet managers to monitor vehicle performance in real-time, leading to informed decision-making. As a result, the commercial vehicle-telematics market is likely to expand, with more companies investing in these technologies to remain competitive.

Regulatory Compliance and Safety Standards

Regulatory compliance is a critical driver for the commercial vehicle-telematics market. In the US, stringent regulations regarding vehicle safety and emissions are prompting fleet operators to adopt telematics solutions. These systems assist in monitoring compliance with regulations such as the Electronic Logging Device (ELD) mandate, which requires accurate tracking of driving hours. Failure to comply can result in hefty fines, making telematics an essential tool for fleet operators. Furthermore, telematics can enhance safety by providing real-time data on driver behavior, vehicle maintenance needs, and accident prevention measures. This focus on compliance and safety is likely to propel the growth of the commercial vehicle-telematics market.

Technological Advancements in Connectivity

Technological advancements in connectivity are significantly influencing the commercial vehicle-telematics market. The proliferation of 5G technology is expected to enhance data transmission speeds and reliability, enabling real-time communication between vehicles and telematics systems. This improved connectivity allows for more sophisticated applications, such as predictive maintenance and advanced driver-assistance systems (ADAS). As these technologies become more accessible, fleet operators are likely to invest in telematics solutions that leverage these advancements. The potential for increased operational efficiency and reduced downtime could drive market growth, as companies seek to capitalize on the benefits of enhanced connectivity.