Rising Prevalence of Eye Disorders

The increasing incidence of eye disorders, particularly age-related macular degeneration and diabetic retinopathy, is a crucial driver for the optical coherence-tomography market. As the population ages, the demand for advanced diagnostic tools rises. In the US, it is estimated that by 2030, around 8.6 million individuals will be affected by age-related macular degeneration. This growing patient population necessitates the adoption of optical coherence-tomography systems, which provide high-resolution imaging for early detection and monitoring of these conditions. The optical coherence-tomography market is thus positioned to expand significantly as healthcare providers seek to enhance diagnostic accuracy and improve patient outcomes.

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in the US is a significant driver for the optical coherence-tomography market. As hospitals and clinics upgrade their facilities and invest in advanced medical technologies, the demand for optical coherence-tomography systems is expected to rise. The US healthcare expenditure is projected to reach $6.2 trillion by 2028, reflecting a commitment to improving healthcare services. This investment in infrastructure supports the optical coherence-tomography market by enabling healthcare providers to offer state-of-the-art diagnostic services, ultimately enhancing patient care and treatment outcomes.

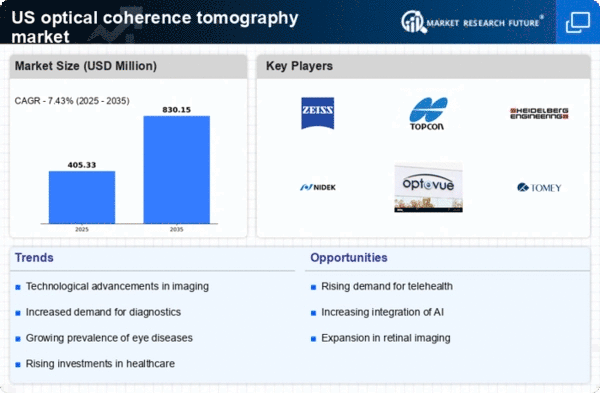

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into optical coherence-tomography systems is transforming the landscape of the optical coherence-tomography market. AI algorithms can analyze imaging data more efficiently, leading to quicker and more accurate diagnoses. This technological advancement is expected to enhance the capabilities of optical coherence-tomography devices, making them more appealing to healthcare providers. In the US, the market for AI in healthcare is projected to reach $36.1 billion by 2025, indicating a strong trend towards incorporating AI in diagnostic tools. The optical coherence-tomography market stands to benefit from this trend, as AI-enhanced systems may improve workflow efficiency and diagnostic precision.

Growing Awareness of Preventive Healthcare

There is a notable increase in awareness regarding preventive healthcare among the US population, which is driving the optical coherence-tomography market. Patients are becoming more proactive about their health, seeking regular eye examinations to detect potential issues early. This shift in consumer behavior is encouraging healthcare providers to invest in advanced diagnostic technologies, including optical coherence-tomography systems. The optical coherence-tomography market is likely to see growth as more individuals prioritize eye health, leading to higher demand for non-invasive imaging techniques that facilitate early diagnosis and treatment.

Regulatory Support for Innovative Technologies

Regulatory support for innovative medical technologies is fostering growth in the optical coherence-tomography market. The US Food and Drug Administration (FDA) has been actively streamlining the approval process for new medical devices, including optical coherence-tomography systems. This regulatory environment encourages manufacturers to develop and introduce advanced imaging technologies. As a result, the optical coherence-tomography market is likely to experience an influx of innovative products that enhance diagnostic capabilities. The supportive regulatory framework may also lead to increased competition, driving further advancements in the technology.