Growing Awareness of Skin Health

There is a notable increase in public awareness regarding skin health, which is positively impacting the dermatology diagnostic-device market. Educational campaigns and initiatives by dermatological associations are informing the public about the importance of early detection of skin conditions. This heightened awareness is leading to more individuals seeking dermatological consultations and diagnostic services. As a result, the demand for diagnostic devices is likely to rise, as healthcare providers aim to meet the needs of an informed patient population. Furthermore, the trend of preventive healthcare is gaining traction, with patients increasingly prioritizing regular skin checks. This shift in consumer behavior suggests a promising outlook for the dermatology diagnostic-device market, as it aligns with the growing emphasis on proactive health management.

Rising Incidence of Skin Disorders

The dermatology diagnostic-device market experiences growth due to the increasing prevalence of skin disorders in the US. Conditions such as psoriasis, eczema, and skin cancer are becoming more common, prompting a greater demand for diagnostic devices. According to the American Academy of Dermatology, skin cancer is the most prevalent form of cancer in the US, affecting millions annually. This rising incidence necessitates advanced diagnostic tools to facilitate early detection and treatment, thereby driving market expansion. Furthermore, the aging population, which is more susceptible to skin conditions, contributes to this trend. As a result, healthcare providers are increasingly investing in innovative diagnostic devices to enhance patient outcomes, indicating a robust growth trajectory for the dermatology diagnostic-device market in the coming years.

Regulatory Support for Innovative Devices

Regulatory bodies in the US are increasingly supporting the development and approval of innovative dermatology diagnostic devices. The Food and Drug Administration (FDA) has streamlined processes for the evaluation of new technologies, facilitating quicker access to the market. This regulatory support encourages manufacturers to invest in research and development, leading to the introduction of cutting-edge diagnostic tools. The dermatology diagnostic-device market is likely to benefit from this favorable regulatory environment, as it fosters innovation and enhances competition among manufacturers. Moreover, the introduction of new devices can address unmet clinical needs, further driving market growth. As regulatory frameworks continue to evolve, the dermatology diagnostic-device market is expected to expand, providing healthcare professionals with advanced tools to improve patient care.

Technological Innovations in Diagnostic Devices

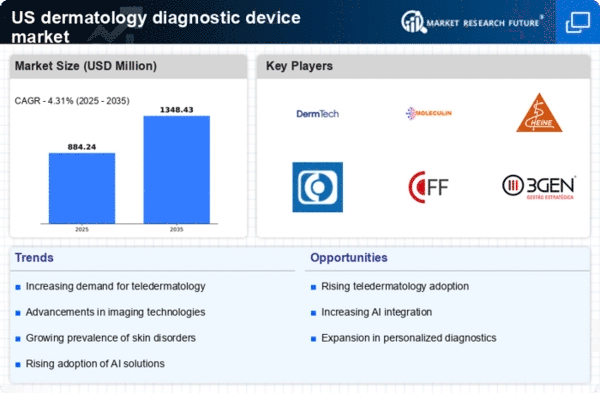

Technological advancements play a pivotal role in shaping the dermatology diagnostic-device market. Innovations such as artificial intelligence (AI) and machine learning are being integrated into diagnostic tools, enhancing their accuracy and efficiency. For instance, AI algorithms can analyze skin lesions with remarkable precision, potentially improving diagnostic outcomes. The market is projected to witness a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by these technological innovations. Additionally, the development of portable and user-friendly devices is making diagnostics more accessible to both healthcare professionals and patients. This trend suggests that the dermatology diagnostic-device market will continue to evolve, with technology serving as a key driver of growth.

Increased Investment in Healthcare Infrastructure

The dermatology diagnostic-device market benefits from heightened investment in healthcare infrastructure across the US. Government initiatives aimed at improving healthcare access and quality are leading to the establishment of more dermatology clinics and specialized centers. This expansion is likely to increase the demand for diagnostic devices, as more facilities require advanced tools to provide effective patient care. According to the Centers for Medicare & Medicaid Services, healthcare spending in the US is projected to reach $6 trillion by 2027, indicating a substantial financial commitment to enhancing healthcare services. Consequently, this investment trend is expected to bolster the dermatology diagnostic-device market, as healthcare providers seek to equip their facilities with state-of-the-art diagnostic technologies.