Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a significant driver for the minimally invasive-surgery-devices market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing investment in advanced surgical technologies. This financial commitment allows hospitals and surgical centers to acquire state-of-the-art minimally invasive devices, enhancing their surgical capabilities. Furthermore, as healthcare systems strive to improve patient outcomes while managing costs, minimally invasive procedures are often seen as a cost-effective solution. This trend indicates a robust market potential as healthcare providers seek to optimize their surgical offerings.

Supportive Reimbursement Policies

Supportive reimbursement policies for minimally invasive procedures are playing a crucial role in the growth of the minimally invasive-surgery-devices market. Insurance companies are increasingly recognizing the benefits of these procedures, leading to favorable reimbursement rates. This trend encourages healthcare providers to adopt minimally invasive techniques, as they can offer patients effective solutions without significant financial burdens. As reimbursement policies continue to evolve, they are likely to further incentivize the use of minimally invasive devices, thereby expanding the market. The alignment of financial incentives with patient care objectives suggests a promising outlook for the industry.

Increasing Prevalence of Chronic Diseases

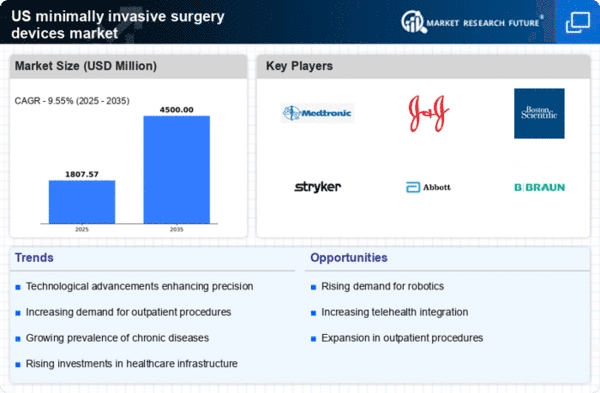

The rising incidence of chronic diseases such as cardiovascular disorders, diabetes, and obesity is a primary driver for the minimally invasive-surgery-devices market. As these conditions often require surgical intervention, the demand for minimally invasive techniques is likely to increase. According to recent data, chronic diseases affect nearly 60% of the US population, leading to a growing need for effective surgical solutions. Minimally invasive procedures are preferred due to their reduced recovery times and lower complication rates, which align with patient preferences for quicker return to daily activities. This trend suggests that healthcare providers are increasingly adopting these devices to meet patient needs, thereby propelling the market forward.

Technological Innovations in Surgical Devices

Technological advancements in surgical devices are significantly influencing the minimally invasive-surgery-devices market. Innovations such as robotic-assisted surgery, advanced imaging techniques, and enhanced visualization tools are transforming surgical practices. For instance, the integration of robotics in surgery has been shown to improve precision and reduce recovery times, making procedures safer and more efficient. The market for robotic surgical systems alone is projected to reach approximately $20 billion by 2026. These innovations not only enhance surgical outcomes but also attract more healthcare facilities to adopt minimally invasive techniques, thereby driving market growth.

Growing Awareness and Acceptance Among Patients

There is a notable increase in patient awareness and acceptance of minimally invasive surgical procedures, which is positively impacting the minimally invasive-surgery-devices market. Patients are becoming more informed about the benefits of these procedures, including shorter hospital stays, reduced pain, and minimal scarring. Surveys indicate that over 70% of patients prefer minimally invasive options when available. This shift in patient preference encourages healthcare providers to offer more minimally invasive solutions, thus expanding the market. As patients advocate for less invasive options, the demand for innovative surgical devices is expected to rise, further stimulating market growth.