Government Initiatives and Funding

Government support and funding initiatives are crucial drivers for the minimally invasive-surgery-devices market. The Japanese government has been actively promoting healthcare reforms aimed at improving surgical outcomes and reducing healthcare costs. Initiatives such as subsidies for hospitals adopting advanced surgical technologies and funding for research and development in minimally invasive techniques are likely to stimulate market growth. In recent years, the government allocated approximately ¥10 billion to support innovative medical technologies, which includes minimally invasive surgical devices. This financial backing not only encourages manufacturers to innovate but also facilitates the adoption of these devices in clinical settings, thereby enhancing the overall market landscape.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in Japan is a significant driver for the minimally invasive-surgery-devices market. Conditions such as cardiovascular diseases, diabetes, and obesity are becoming increasingly prevalent, necessitating effective surgical interventions. Data indicates that nearly 30% of the Japanese population is affected by chronic diseases, leading to a higher demand for surgical solutions that minimize patient trauma. Minimally invasive procedures are often preferred for treating these conditions due to their associated benefits, such as shorter hospital stays and quicker recovery times. As healthcare providers seek to address the growing burden of chronic diseases, the demand for minimally invasive surgical devices is expected to rise, further propelling market growth.

Technological Innovations in Surgical Devices

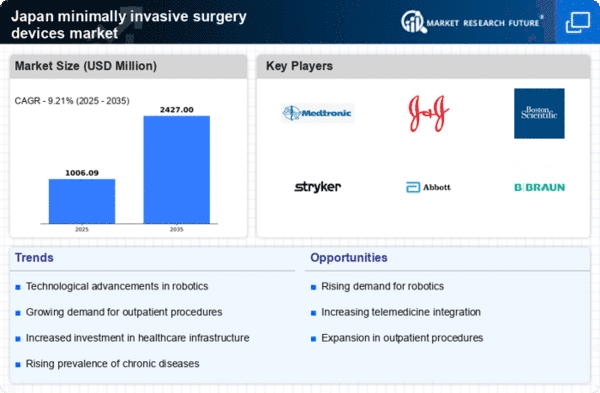

Technological advancements play a pivotal role in shaping the minimally invasive-surgery-devices market. Innovations such as robotic-assisted surgery, advanced imaging techniques, and enhanced surgical instruments are revolutionizing surgical practices in Japan. For instance, the integration of robotics in surgical procedures has shown to improve precision and reduce the duration of surgeries. The market for robotic surgical systems is projected to reach approximately $1.5 billion by 2026, indicating a robust growth trajectory. These innovations not only enhance surgical outcomes but also attract more healthcare facilities to invest in state-of-the-art minimally invasive technologies, thereby driving market growth. As hospitals and clinics seek to improve patient care and operational efficiency, the demand for technologically advanced surgical devices is expected to rise significantly.

Rising Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive procedures among patients in Japan is a key driver for the minimally invasive-surgery-devices market. Patients are increasingly aware of the benefits associated with these procedures, such as reduced recovery times, minimal scarring, and lower risk of complications. According to recent data, approximately 70% of patients express a preference for minimally invasive options when available. This shift in patient preference is prompting healthcare providers to adopt advanced surgical techniques, thereby driving the demand for innovative devices in the market. Furthermore, as the aging population in Japan continues to grow, the need for effective surgical solutions that minimize patient discomfort and expedite recovery is likely to further bolster the market's expansion.

Growing Awareness and Education on Surgical Options

The increasing awareness and education regarding surgical options among both healthcare professionals and patients are driving the minimally invasive-surgery-devices market. Educational campaigns and training programs aimed at surgeons and medical staff are enhancing knowledge about the benefits and techniques of minimally invasive surgeries. This heightened awareness is leading to a greater acceptance of these procedures among patients, who are more likely to inquire about minimally invasive options during consultations. As a result, healthcare providers are compelled to expand their offerings of minimally invasive procedures, thereby increasing the demand for related surgical devices. The trend suggests that as education continues to improve, the market for minimally invasive surgical devices will likely experience sustained growth.