Increased Awareness and Education

Increased awareness and education regarding stroke symptoms and risk factors are pivotal in shaping the ischemic stroke market. Public health campaigns aimed at educating the population about the signs of stroke and the importance of timely medical intervention have led to higher rates of early diagnosis and treatment. The American Stroke Association has reported that awareness initiatives have contributed to a notable increase in the number of patients seeking immediate care, which is crucial for improving outcomes. This heightened awareness is likely to drive demand for various treatment modalities within the ischemic stroke market, as more individuals recognize the need for effective management of their health.

Rising Incidence of Ischemic Stroke

The increasing incidence of ischemic stroke in the US is a primary driver for the ischemic stroke market. According to the Centers for Disease Control and Prevention (CDC), approximately 795,000 people experience a stroke annually, with ischemic strokes accounting for about 87% of all cases. This growing prevalence is attributed to factors such as an aging population, lifestyle choices, and comorbidities like hypertension and diabetes. As the number of patients requiring treatment rises, the demand for innovative therapies and interventions in the ischemic stroke market is expected to expand significantly. This trend suggests that healthcare providers and pharmaceutical companies may need to enhance their offerings to address the increasing patient population effectively.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is emerging as a crucial driver in the ischemic stroke market. The US Food and Drug Administration (FDA) has been actively approving new treatments and devices aimed at improving outcomes for stroke patients. Recent approvals for novel anticoagulants and neuroprotective agents suggest a favorable environment for innovation. This regulatory landscape encourages pharmaceutical companies to invest in research and development, potentially leading to breakthroughs in ischemic stroke management. As new therapies enter the market, they may offer improved efficacy and safety profiles, thereby attracting more healthcare providers and patients to adopt these advancements in the ischemic stroke market.

Technological Innovations in Medical Devices

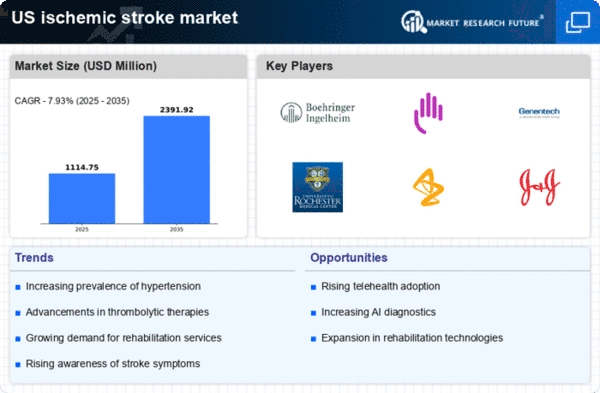

Technological advancements in medical devices are transforming the ischemic stroke market. Innovations such as thrombectomy devices and advanced imaging technologies are enhancing the ability to diagnose and treat ischemic strokes promptly. For instance, the introduction of stent retrievers has improved the success rates of mechanical thrombectomy procedures, which are critical in acute ischemic stroke management. The market for these devices is projected to grow, with estimates suggesting a compound annual growth rate (CAGR) of around 7% over the next few years. This growth is likely driven by the increasing adoption of minimally invasive procedures and the need for effective treatment options, thereby propelling the ischemic stroke market forward.

Growing Investment in Healthcare Infrastructure

The growing investment in healthcare infrastructure in the US is a significant driver for the ischemic stroke market. Enhanced healthcare facilities, including specialized stroke centers, are being established to provide comprehensive care for stroke patients. This investment is reflected in the increasing number of hospitals equipped with advanced imaging and treatment technologies, which are essential for managing ischemic strokes effectively. According to the American Hospital Association, healthcare spending is projected to reach $6 trillion by 2027, indicating a robust commitment to improving patient care. Such developments are likely to facilitate better access to treatment options, thereby stimulating growth in the ischemic stroke market.