Rising Chronic Disease Prevalence

The increasing prevalence of chronic diseases in the US is a pivotal driver for the injectable drug-delivery-devices market. Conditions such as diabetes, cancer, and cardiovascular diseases necessitate effective management strategies, often requiring injectable therapies. According to the Centers for Disease Control and Prevention (CDC), approximately 6 in 10 adults in the US have a chronic disease, which underscores the growing demand for innovative drug delivery solutions. This trend is likely to propel the market forward, as healthcare providers seek efficient methods to administer medications. The injectable drug-delivery-devices market is expected to witness substantial growth, potentially reaching a valuation of $XX billion by 2027, driven by the need for effective treatment options for these prevalent conditions.

Increased Focus on Patient Compliance

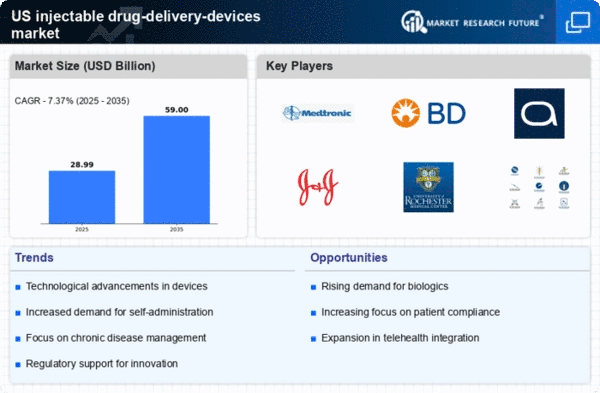

Patient compliance remains a critical concern in the healthcare sector, particularly in the context of chronic disease management. The injectable drug-delivery-devices market is experiencing growth as these devices enhance adherence to prescribed therapies. Devices that offer features such as auto-injection and reminder systems are becoming increasingly popular, as they simplify the administration process for patients. A study indicated that adherence rates can improve by up to 30% with the use of user-friendly injectable devices. This focus on patient compliance is likely to drive innovation and investment in the injectable drug-delivery-devices market, as manufacturers strive to create solutions that meet the needs of both patients and healthcare providers.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is reshaping the injectable drug-delivery-devices market. Innovations such as smart devices, connected health solutions, and digital health platforms are enhancing the functionality and appeal of injectable devices. For instance, smart injectors that track dosage and provide feedback to patients are gaining traction. The market for connected health solutions is expected to grow at a CAGR of XX% over the next five years, indicating a robust demand for technologically advanced drug delivery systems. This integration not only improves patient outcomes but also streamlines healthcare processes, thereby driving the injectable drug-delivery-devices market forward.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is emerging as a significant driver for the injectable drug-delivery-devices market. As healthcare moves towards tailored therapies that cater to individual patient needs, the demand for devices that can deliver these customized treatments is likely to increase. Personalized medicine often involves the use of biologics and targeted therapies, which require precise delivery mechanisms. The market for personalized medicine is projected to grow substantially, with estimates suggesting a value of $XX billion by 2028. This trend indicates that the injectable drug-delivery-devices market must adapt to accommodate the unique requirements of personalized therapies, fostering innovation and growth.

Advancements in Biologics and Biosimilars

The rise of biologics and biosimilars is significantly influencing the injectable drug-delivery-devices market. Biologics, which are derived from living organisms, often require specialized delivery systems to ensure efficacy and safety. The US market for biologics is projected to reach $XX billion by 2026, reflecting a growing reliance on these therapies. As more biologics enter the market, the demand for advanced delivery devices that can accommodate their unique properties is likely to increase. This trend suggests that manufacturers of injectable drug-delivery devices must innovate continuously to keep pace with the evolving landscape of biologics and biosimilars, thereby driving market growth.