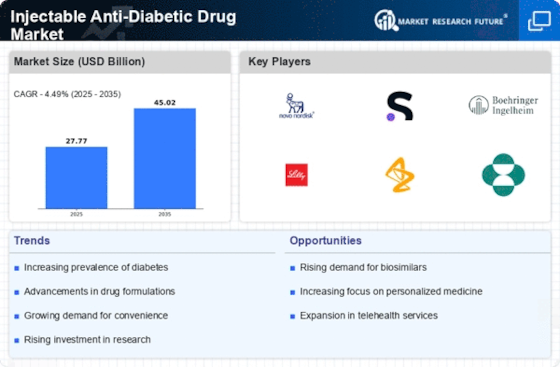

Rising Prevalence of Diabetes

The increasing prevalence of diabetes worldwide is a primary driver for the Injectable Anti-Diabetic Drug Market. According to recent estimates, the number of individuals diagnosed with diabetes is projected to reach approximately 700 million by 2045. This alarming trend necessitates effective treatment options, thereby propelling the demand for injectable anti-diabetic medications. As healthcare systems strive to manage this growing burden, the Injectable Anti-Diabetic Drug Market is likely to expand significantly. The rise in diabetes cases is attributed to various factors, including sedentary lifestyles, unhealthy diets, and genetic predispositions. Consequently, pharmaceutical companies are focusing on developing innovative injectable therapies to cater to this increasing patient population, which may further stimulate market growth.

Growing Awareness and Education

The rising awareness and education surrounding diabetes management are significantly influencing the Injectable Anti-Diabetic Drug Market. Healthcare providers and organizations are increasingly focusing on patient education initiatives, which aim to empower individuals with diabetes to manage their condition effectively. This heightened awareness leads to a greater understanding of treatment options, including injectable therapies. As patients become more informed about the benefits of these medications, the demand for injectable anti-diabetic drugs is likely to increase. Furthermore, educational campaigns that emphasize the importance of adherence to prescribed therapies may enhance patient compliance, ultimately driving market growth. The Injectable Anti-Diabetic Drug Market stands to benefit from this trend, as more patients seek effective solutions to manage their diabetes.

Advancements in Drug Formulations

Innovations in drug formulations are transforming the Injectable Anti-Diabetic Drug Market. Recent advancements have led to the development of long-acting insulin and GLP-1 receptor agonists, which offer improved glycemic control and patient compliance. These novel formulations are designed to enhance the pharmacokinetic profiles of existing drugs, allowing for less frequent dosing and better management of blood glucose levels. As a result, the market is witnessing a shift towards more effective and user-friendly injectable options. The introduction of combination therapies that integrate multiple mechanisms of action is also gaining traction, potentially leading to better therapeutic outcomes. This trend indicates a promising future for the Injectable Anti-Diabetic Drug Market, as healthcare providers increasingly adopt these advanced formulations to optimize diabetes management.

Regulatory Support for New Therapies

Regulatory support for the approval of new injectable anti-diabetic therapies is playing a pivotal role in shaping the Injectable Anti-Diabetic Drug Market. Regulatory agencies are increasingly streamlining the approval processes for innovative treatments, thereby expediting their availability to patients. This supportive environment encourages pharmaceutical companies to invest in the development of novel injectable drugs, which may address unmet medical needs in diabetes management. The introduction of expedited pathways for promising therapies is likely to enhance market dynamics, as new products can reach the market more swiftly. Consequently, the Injectable Anti-Diabetic Drug Market is expected to experience growth driven by the influx of new therapies that offer improved treatment options for patients with diabetes.

Increased Investment in Diabetes Research

The surge in investment for diabetes research and development is a crucial driver for the Injectable Anti-Diabetic Drug Market. Governments and private entities are allocating substantial funds to explore innovative treatment options and improve existing therapies. This financial commitment is fostering a conducive environment for the discovery of new injectable anti-diabetic drugs, which may offer enhanced efficacy and safety profiles. Additionally, collaborations between pharmaceutical companies and research institutions are becoming more prevalent, facilitating the rapid translation of scientific discoveries into clinical applications. As a result, the Injectable Anti-Diabetic Drug Market is poised for growth, with a pipeline of promising therapies expected to emerge in the coming years. This trend underscores the importance of continued investment in diabetes research to address the evolving needs of patients.