Expansion of Telehealth Services

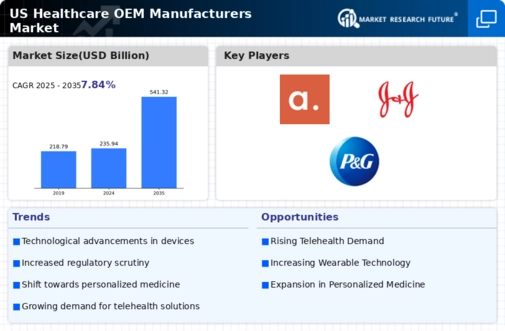

The expansion of telehealth services is significantly impacting the healthcare oem-manufacturers market. As healthcare providers increasingly adopt telehealth solutions, there is a corresponding demand for devices that facilitate remote patient monitoring and virtual consultations. This shift is likely to drive innovation in medical devices that are compatible with telehealth platforms. The telehealth market in the US is projected to grow at a CAGR of over 25% through 2026, suggesting a robust opportunity for healthcare oem-manufacturers to develop products that cater to this evolving landscape. By aligning their offerings with the needs of telehealth providers, manufacturers can capitalize on this trend and enhance their market presence.

Rising Demand for Advanced Medical Devices

There is a notable surge in demand for advanced medical devices. This trend is driven by an increasing prevalence of chronic diseases and an aging population, which necessitates innovative healthcare solutions. According to recent data, the medical device market in the US is projected to reach approximately $208 billion by 2025, reflecting a compound annual growth rate (CAGR) of around 5.4%. This growth is likely to propel healthcare oem-manufacturers to enhance their production capabilities and invest in research and development. As healthcare providers seek to improve patient outcomes, the emphasis on high-quality, technologically advanced devices becomes paramount, thereby creating a robust environment for healthcare oem-manufacturers to thrive.

Regulatory Compliance and Quality Standards

Stringent regulatory compliance and quality standards significantly influence the market. In the US, the Food and Drug Administration (FDA) imposes rigorous guidelines that manufacturers must adhere to in order to ensure the safety and efficacy of medical devices. This regulatory landscape compels healthcare oem-manufacturers to invest in quality management systems and continuous improvement processes. As a result, companies that prioritize compliance are likely to gain a competitive edge, as they can more effectively navigate the complexities of the market. The emphasis on quality assurance not only enhances product reliability but also fosters trust among healthcare providers and patients, thereby driving demand within the healthcare oem-manufacturers market.

Increased Focus on Patient-Centric Solutions

There is an increased focus on patient-centric solutions. As healthcare systems evolve, there is a growing recognition of the importance of tailoring medical devices to meet the specific needs of patients. This trend is reflected in the rising demand for wearable health technology and remote monitoring devices, which empower patients to take control of their health. According to industry reports, the wearable medical device market is expected to reach $27 billion by 2026, indicating a substantial opportunity for healthcare oem-manufacturers. By prioritizing patient-centric design and functionality, manufacturers can enhance user experience and satisfaction, ultimately driving growth in the healthcare oem-manufacturers market.

Technological Advancements in Manufacturing Processes

Technological advancements in manufacturing processes are reshaping the healthcare oem-manufacturers market. Innovations such as automation, 3D printing, and artificial intelligence are streamlining production and enhancing efficiency. For instance, 3D printing allows for rapid prototyping and customization of medical devices, which can significantly reduce time-to-market. The integration of AI in manufacturing processes can optimize supply chain management and predictive maintenance, leading to cost reductions. As these technologies become more accessible, healthcare oem-manufacturers are likely to adopt them to remain competitive. This shift not only improves operational efficiency but also enables manufacturers to respond swiftly to changing market demands, thereby fostering growth in the healthcare oem-manufacturers market.