Expansion of Value-Based Care Models

The transition towards value-based care models is significantly influencing the healthcare analytics market. As healthcare providers shift their focus from volume to value, there is an increasing need for analytics solutions that can measure and improve patient outcomes. This shift is expected to drive the market's growth, with estimates suggesting a potential increase in market size to $60 billion by 2027. Analytics tools are essential for tracking performance metrics, patient satisfaction, and cost-effectiveness, thereby enabling providers to align their services with value-based care principles. Consequently, the healthcare analytics market is becoming integral to the operational strategies of healthcare organizations.

Growing Emphasis on Patient Engagement

The healthcare analytics market is also being driven by a growing emphasis on patient engagement. Healthcare organizations are increasingly utilizing analytics to understand patient behaviors, preferences, and outcomes. By leveraging data, providers can develop targeted strategies to enhance patient engagement, which is crucial for improving health outcomes and satisfaction. The market is projected to expand significantly, with estimates indicating a potential valuation of $55 billion by 2028. This focus on patient-centric care is prompting healthcare organizations to invest in analytics solutions that facilitate personalized communication and tailored interventions, thereby reinforcing the importance of the healthcare analytics market.

Rising Demand for Data-Driven Decision Making

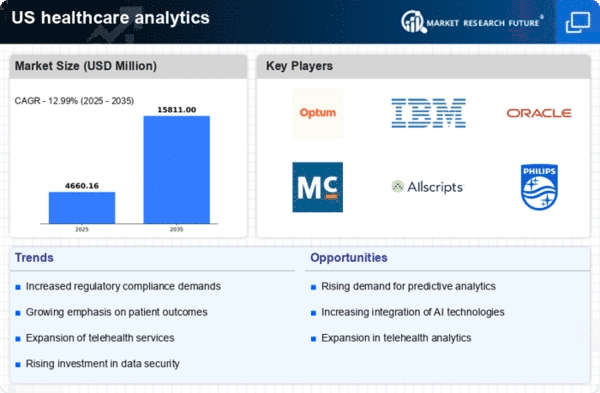

The healthcare analytics market is experiencing a notable surge in demand for data-driven decision making. Healthcare organizations are increasingly recognizing the value of leveraging data to enhance operational efficiency and improve patient outcomes. According to recent estimates, The market is projected to reach approximately $50 billion by 2026, reflecting a compound annual growth rate (CAGR) of 12.99%. This growth is largely attributed to the need for actionable insights derived from vast amounts of healthcare data. As providers seek to optimize resource allocation and streamline processes, the healthcare analytics market is positioned to play a pivotal role in shaping the future of healthcare delivery.

Technological Advancements in Data Management

Technological advancements in data management are propelling the healthcare analytics market forward. Innovations such as cloud computing, big data technologies, and advanced data visualization tools are enhancing the ability of healthcare organizations to collect, analyze, and interpret data. These technologies facilitate real-time analytics, which is crucial for timely decision making in clinical settings. The market is anticipated to grow at a CAGR of approximately 22% over the next few years, driven by the increasing adoption of these technologies. As healthcare providers seek to harness the power of data, the healthcare analytics market is likely to see substantial investment and development.

Increased Investment in Healthcare IT Infrastructure

Increased investment in healthcare IT infrastructure is a critical driver of the healthcare analytics market. As healthcare organizations recognize the importance of robust IT systems for data management and analytics, funding for technology upgrades is on the rise. This trend is expected to contribute to a market growth rate of around 20% annually over the next few years. Enhanced IT infrastructure enables better data integration, interoperability, and security, which are essential for effective analytics. Consequently, the healthcare analytics market is likely to benefit from these investments, as organizations seek to improve their analytical capabilities and overall operational efficiency.