Rising Demand for Predictive Insights

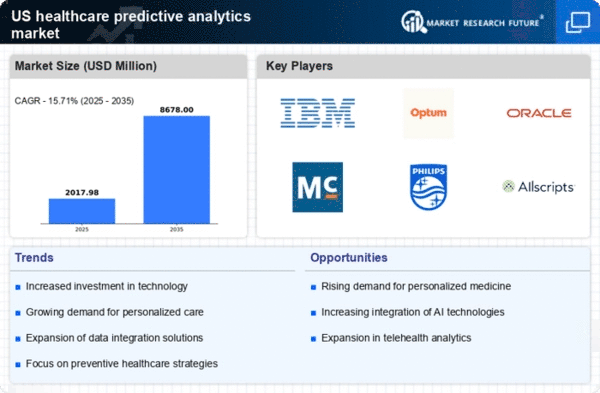

The healthcare predictive-analytics market is experiencing a notable surge in demand for predictive insights, driven by the need for improved patient outcomes and operational efficiency. Healthcare providers are increasingly recognizing the value of data-driven decision-making, which allows for proactive interventions and personalized care plans. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is largely attributed to the increasing complexity of patient data and the necessity for healthcare organizations to leverage analytics to enhance clinical workflows. As a result, The healthcare predictive-analytics market is becoming an essential component in the strategic planning of healthcare institutions. It enables them to anticipate patient needs and allocate resources more effectively.

Advancements in Data Collection Technologies

Technological advancements in data collection methods are significantly influencing the healthcare predictive-analytics market. The proliferation of wearable devices, mobile health applications, and electronic health records (EHRs) has facilitated the gathering of vast amounts of patient data. This influx of data presents both opportunities and challenges for healthcare providers, as they must develop robust analytics capabilities to extract actionable insights. The integration of real-time data collection tools is expected to enhance the accuracy of predictive models, thereby improving patient care and operational efficiency. As healthcare organizations invest in these technologies, the healthcare predictive-analytics market is likely to expand, with a projected market value reaching $10 billion by 2027.

Increased Focus on Chronic Disease Management

The growing prevalence of chronic diseases in the US is driving the healthcare predictive-analytics market towards innovative solutions for disease management. Chronic conditions such as diabetes, heart disease, and obesity require continuous monitoring and tailored interventions. Predictive analytics enables healthcare providers to identify at-risk patients and implement preventive measures, ultimately reducing hospital readmissions and healthcare costs. It is estimated that chronic diseases account for nearly 75% of healthcare expenditures in the US, underscoring the need for effective management strategies. Consequently, the healthcare predictive-analytics market is positioned to play a crucial role in addressing these challenges, as organizations seek to leverage data analytics to enhance patient care and optimize resource allocation.

Regulatory Initiatives Promoting Data Sharing

Regulatory initiatives aimed at promoting data sharing are significantly impacting the healthcare predictive-analytics market. Policies that encourage interoperability among healthcare systems facilitate the seamless exchange of patient information, which is vital for effective predictive analytics. The implementation of regulations such as the 21st Century Cures Act is designed to enhance data accessibility and empower patients with their health information. As healthcare organizations adapt to these regulatory changes, they are increasingly adopting predictive analytics tools to harness the power of shared data. This trend is expected to drive market growth, as organizations recognize the potential of collaborative data utilization in improving patient care and operational efficiency within the healthcare predictive-analytics market.

Growing Investment in Healthcare IT Infrastructure

Investment in healthcare IT infrastructure is a critical driver of the healthcare predictive-analytics market. As healthcare organizations strive to modernize their systems, there is a concerted effort to integrate advanced analytics capabilities into existing IT frameworks. This shift is fueled by the recognition that robust IT infrastructure is essential for effective data management and analytics. According to industry reports, spending on healthcare IT is expected to exceed $200 billion by 2026, with a significant portion allocated to predictive analytics solutions. This investment not only enhances the capabilities of healthcare providers but also fosters collaboration among stakeholders, ultimately leading to improved patient outcomes and operational efficiencies within the healthcare predictive-analytics market.