Increased Focus on Value-Based Care

The shift towards value-based care is a significant driver within the Healthcare Analytics Market. This model emphasizes patient outcomes and cost-effectiveness rather than the volume of services provided. As healthcare systems transition to value-based care, the demand for analytics solutions that can measure and report on quality metrics becomes paramount. Healthcare organizations are increasingly utilizing analytics to track performance indicators, patient satisfaction, and treatment efficacy. This trend is reflected in the projected growth of the healthcare analytics market, which is anticipated to reach USD 50 billion by 2026. By leveraging analytics, providers can identify areas for improvement, optimize resource allocation, and enhance patient care, thereby aligning with the goals of value-based care. Consequently, the focus on value-based care is likely to drive further investment in healthcare analytics solutions.

Advancements in Technology and Infrastructure

Technological advancements play a crucial role in shaping the Healthcare Analytics Market. The proliferation of electronic health records (EHRs), cloud computing, and big data technologies has transformed how healthcare data is collected, stored, and analyzed. These innovations facilitate the seamless integration of analytics tools into existing healthcare systems, enabling providers to harness data more effectively. For instance, the adoption of cloud-based analytics solutions is expected to increase significantly, as they offer scalability and cost-effectiveness. Furthermore, the rise of machine learning and artificial intelligence enhances predictive analytics capabilities, allowing healthcare organizations to anticipate patient needs and improve service delivery. As technology continues to evolve, the Healthcare Analytics Market is poised for substantial growth, driven by the need for sophisticated analytical tools that can support complex healthcare environments.

Regulatory Compliance and Data Security Needs

Regulatory compliance and data security are critical considerations in the Healthcare Analytics Market. As healthcare organizations handle sensitive patient information, adherence to regulations such as HIPAA is essential. The increasing complexity of data privacy laws necessitates robust analytics solutions that can ensure compliance while safeguarding patient data. Organizations are investing in analytics tools that not only provide insights but also incorporate security features to protect against data breaches. The demand for secure analytics solutions is expected to rise, as healthcare providers seek to mitigate risks associated with data handling. This focus on compliance and security is likely to drive innovation within the healthcare analytics sector, as companies develop solutions that meet regulatory requirements while delivering valuable insights.

Rising Demand for Data-Driven Decision Making

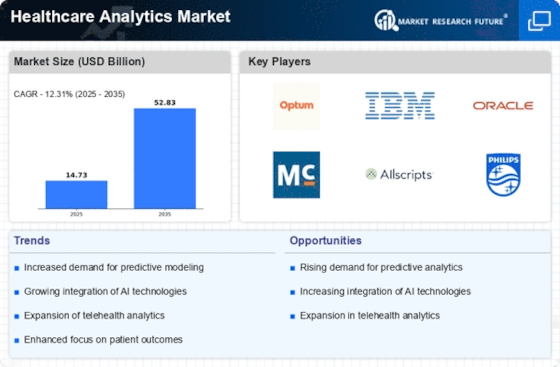

The increasing emphasis on data-driven decision making within the Healthcare Analytics Market is a pivotal driver. Healthcare organizations are increasingly recognizing the value of analytics in improving patient outcomes and operational efficiency. According to recent estimates, the healthcare analytics market is projected to reach USD 50 billion by 2026, reflecting a compound annual growth rate of approximately 25%. This surge is largely attributed to the need for actionable insights derived from vast amounts of healthcare data. As healthcare providers strive to enhance care quality while managing costs, the integration of analytics into clinical and administrative processes becomes essential. Consequently, the demand for advanced analytics solutions is likely to continue growing, as stakeholders seek to leverage data for strategic planning and resource allocation.

Growing Importance of Population Health Management

Population health management is emerging as a vital driver in the Healthcare Analytics Market. As healthcare providers aim to improve health outcomes for specific populations, the need for analytics that can identify trends, risks, and opportunities becomes increasingly important. By analyzing data from diverse sources, including social determinants of health, providers can develop targeted interventions that address the unique needs of different patient groups. The healthcare analytics market is projected to experience substantial growth, with an increasing number of organizations adopting analytics solutions to support population health initiatives. This trend reflects a broader recognition of the importance of proactive health management, which is likely to shape the future of healthcare delivery. As a result, the emphasis on population health management is expected to drive demand for advanced analytics capabilities.