Market Trends

Key Emerging Trends in the US Green Steel Market

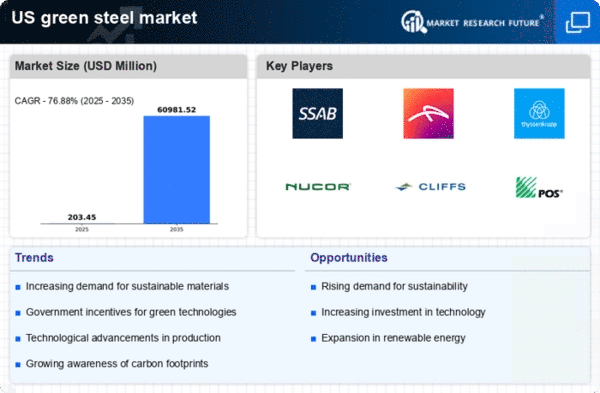

The US Green Steel Market is currently witnessing transformative trends that underscore the industry's commitment to sustainability and environmental responsibility. One prominent trend is the increasing adoption of green steel production methods, specifically through the use of renewable energy sources and low-carbon technologies. As the demand for sustainable practices rises, steel manufacturers are investing in technologies that reduce carbon emissions, such as electric arc furnaces powered by renewable energy. This trend reflects the industry's response to the global push for decarbonization and the shift towards more environmentally friendly steel production processes.

Moreover, the circular economy is influencing market trends in the US Green Steel Market. The emphasis on recycling and reusing materials is driving innovations in steel manufacturing. Scrap-based production methods, where recycled steel is utilized as a primary raw material, are gaining prominence. This trend aligns with the broader goals of reducing the environmental impact of steel production, conserving resources, and minimizing waste. Green steel manufacturers are actively participating in circular economy initiatives to create a more sustainable and efficient steel production cycle.

Technological advancements in green steel production are shaping market dynamics. The development of breakthrough technologies, such as hydrogen-based direct reduction processes, is gaining attention in the industry. These processes aim to replace traditional coal-based methods with hydrogen, resulting in a significant reduction in carbon emissions. The integration of innovative technologies is essential for achieving the ambitious carbon reduction targets set by the steel industry and aligning with global efforts to combat climate change.

Government initiatives and regulations are playing a pivotal role in shaping the US Green Steel Market. Supportive policies, incentives, and regulatory frameworks that encourage the adoption of green and low-carbon steel production methods are driving market trends. As governments prioritize environmental sustainability, green steel manufacturers benefit from policies that promote cleaner technologies, renewable energy usage, and carbon reduction initiatives. Regulatory compliance is becoming a key factor in the strategic planning of green steel producers.

The construction and infrastructure sectors are contributing significantly to the demand for green steel in the US. The growing awareness of the environmental impact of construction materials has led to a surge in demand for sustainably produced steel. Green steel, with its lower carbon footprint, is becoming a preferred choice for infrastructure projects, building construction, and sustainable urban development. This trend reflects the increasing influence of green building standards and sustainable construction practices on the steel market.

Investments and collaborations are driving growth in the US Green Steel Market. Companies are actively seeking partnerships, forming alliances, and attracting investments to accelerate research, development, and deployment of green steel technologies. Collaboration between steel manufacturers, technology providers, and investors is crucial for scaling up green steel production capacities and making sustainable steel a mainstream choice in the market. These investments demonstrate the industry's commitment to driving innovation and achieving long-term environmental goals.

Supply chain transparency and eco-labeling are emerging trends in the US Green Steel Market. Consumers and businesses are increasingly conscious of the environmental impact of the products they use. Green steel producers are responding to this trend by providing transparent information about the carbon footprint of their products and obtaining eco-label certifications. These initiatives enhance market trust, allowing consumers and businesses to make informed choices that align with their sustainability goals.

E-commerce and digitalization are influencing the distribution channels of green steel products in the US. Online platforms are becoming important channels for green steel manufacturers to reach a wider audience, provide product information, and facilitate transactions. The accessibility of green steel products through e-commerce platforms contributes to increased market awareness and adoption, especially among environmentally conscious consumers and businesses.

Leave a Comment