Top Industry Leaders in the US Green Steel Market

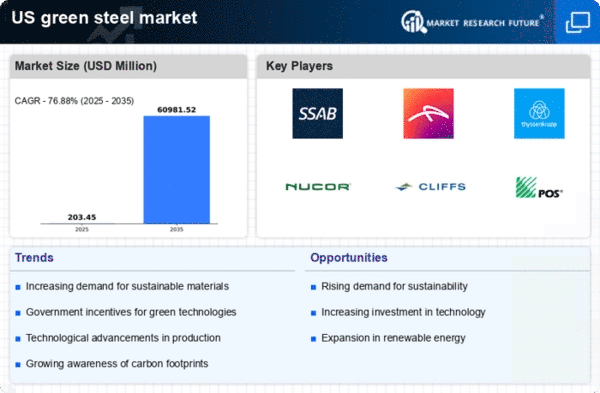

The US steel industry, long a stalwart of infrastructure and manufacturing, is undergoing a transformation driven by sustainability. Green steel, produced with significantly lower carbon emissions compared to traditional methods, is emerging as a game-changer, attracting investment, sparking innovation, and reshaping the competitive landscape.

Market Strategies Heating Up:

-

Technology Diversification: Established players like Cleveland-Cliffs are investing in hydrogen-based Direct Reduced Iron (DRI) plants, while startups like Boston Metal are pioneering electro-refining methods. August 2023 saw ArcelorMittal announce a partnership with H2 Green Steel to explore green hydrogen production in the US. -

Vertical Integration: Companies like Steel Dynamics are acquiring scrap metal processors and recycling facilities to secure feedstock for their electric arc furnaces (EAFs), a low-carbon alternative to blast furnaces. In July 2023, Nucor signed a deal with Big River Steel to secure additional scrap supply. -

Partnerships and Alliances: Collaboration is key. SSAB, an early green steel pioneer, entered a joint venture with POSCO in June 2023 to build a green steel plant in Alabama. Meanwhile, the Green Hydrogen Coalition, formed in May 2023, brings together industry leaders to advocate for policy support.

Factors Shaping Market Share:

-

Cost Competitiveness: While green steel currently carries a premium, production costs are steadily declining with technological advancements and economies of scale. July 2023 saw the first commercial delivery of green steel in the US by EVRAZ North America, marking a significant cost breakthrough. -

Policy Landscape: Government incentives like tax breaks and carbon pricing can tip the scales for green steel producers. The Inflation Reduction Act of 2022 offers tax credits for clean energy investments, potentially boosting the market. -

Customer Demand: Green steel is attracting interest from sustainability-conscious corporations like Microsoft and Tesla. September 2023 saw Ford announce a partnership with ArcelorMittal to use green steel in its vehicles, signaling a growing appetite from automakers.

Key Companies in the green steel market include

- Ansteel Group (China)

- ArcelorMittal (Luxembourg)

- Boston Metal (U.S.)

- China Baowu Group (China)

- Cleveland-Cliffs (U.S.)

- H2 Green Steel (U.S.)

- Nippon Steel Corporation (Japan)

- Nucor Corporation (U.S.)

- Steel Dynamics, Inc. (U.S.)

- United States Steel Corporation (U.S.)

Recent Developments

-

October 2023: The world's first green pig iron facility opens in Alabama, a joint venture between SSAB and POSCO. -

November 2023: Cleveland-Cliffs announces plans to build a $3 billion hydrogen DRI plant in Texas. -

December 2023: The US Department of Energy awards $80 million in grants to support green steel research and development projects.