Us Green Steel Size

US Green Steel Market Growth Projections and Opportunities

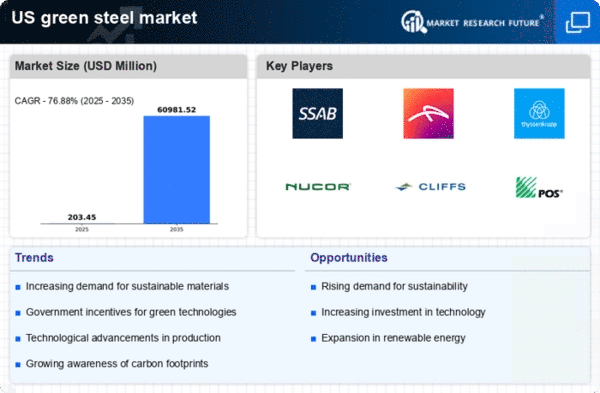

The US Green Steel Market is influenced by a combination of market factors that collectively shape its growth and trajectory. A significant driver is the increasing emphasis on sustainability and the transition towards a low-carbon economy. Green steel, produced using environmentally friendly technologies with reduced carbon emissions, aligns with the global commitment to address climate change. As industries strive to reduce their carbon footprint, there is a growing demand for green steel as a cleaner and more sustainable alternative to traditional steel production methods, driving the development of the green steel market in the US.

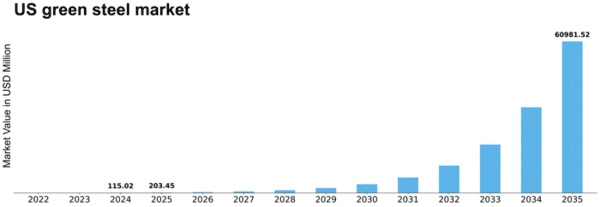

US Green Steel Market Size was valued at USD 0.7 Billion in 2022. The green steel industry is projected to grow from USD 1.17 Billion in 2023 to USD 31.055 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 50.50%

Government policies and regulatory frameworks play a pivotal role in shaping the US Green Steel Market. The implementation of carbon reduction targets, emission standards, and incentives for sustainable practices create a favorable environment for the adoption of green steel technologies. Government support in the form of grants, subsidies, and tax incentives encourages the steel industry to invest in green technologies, accelerating the transition towards more sustainable steel production processes in the United States.

Technological advancements in green steel production contribute significantly to market dynamics. Innovations such as hydrogen-based direct reduction and electric arc furnaces powered by renewable energy sources are transforming the steel manufacturing landscape. These technologies not only reduce carbon emissions but also enhance energy efficiency, positioning green steel as a viable and competitive option in the market. Continuous research and development efforts are key to unlocking the full potential of green steel technologies and expanding their application across the industry.

Market dynamics are influenced by the construction and infrastructure sectors, which are major consumers of steel products. The demand for sustainable and eco-friendly construction materials has led to an increased interest in green steel. As architects, builders, and infrastructure developers prioritize environmentally responsible choices, the use of green steel in construction projects becomes a key factor in the market's growth. The construction industry's commitment to green building practices drives the adoption of green steel as a preferred material in structural and architectural applications.

Investments in renewable energy projects contribute to the growth of the US Green Steel Market. The integration of renewable energy sources, such as solar and wind power, into steel production processes further reduces the carbon footprint of the industry. Steel manufacturers leveraging clean energy solutions not only contribute to the decarbonization of the sector but also position themselves as environmentally responsible entities in the market.

Market competition and industry collaborations play a crucial role in advancing the green steel market. The presence of both traditional and emerging steel producers fosters a competitive landscape. Collaborations between steel manufacturers, technology providers, and research institutions facilitate the development and deployment of green steel technologies. Partnerships across the industry supply chain contribute to knowledge exchange, innovation, and the overall advancement of green steel solutions.

Global economic conditions and trade dynamics impact the US Green Steel Market. As a globally traded commodity, green steel is subject to international market forces, trade agreements, and geopolitical events. Factors such as trade tariffs, trade alliances, and shifts in global demand can influence the accessibility and cost competitiveness of green steel in the US market.

Challenges related to scalability, cost-effectiveness, and infrastructure development for green steel technologies are factors that the industry must address. While green steel offers significant environmental benefits, the scalability of production processes and the economic viability of large-scale adoption remain critical considerations. Infrastructure development, including the establishment of hydrogen production and storage facilities, is essential for realizing the full potential of green steel technologies in the United States.

Leave a Comment