Rising Protein Consumption

The growing awareness of the importance of protein in diets is a significant driver for the frozen processed-meat market. With an increasing number of consumers recognizing protein's role in muscle maintenance and overall health, demand for protein-rich foods has surged. Data indicates that protein consumption in the US has risen by approximately 15% over the past five years, with frozen processed meats being a popular source. This trend is particularly evident among fitness enthusiasts and health-conscious individuals who seek convenient ways to meet their protein needs. The frozen processed-meat market is likely to capitalize on this trend by promoting high-protein products and developing new offerings that cater to this health-oriented consumer base.

Convenience and Time-Saving

The frozen processed-meat market benefits from the increasing demand for convenience foods among consumers. Busy lifestyles have led to a preference for quick meal solutions, with frozen processed meats offering an easy and time-efficient option. According to recent data, approximately 60% of households in the US prioritize convenience when selecting food products. This trend is particularly pronounced among working families and millennials, who often seek ready-to-cook or ready-to-eat meals. The frozen processed-meat market is well-positioned to cater to this demand, as products can be stored for extended periods without compromising quality. As a result, manufacturers are likely to innovate and expand their offerings to include a wider variety of convenient options, further driving market growth.

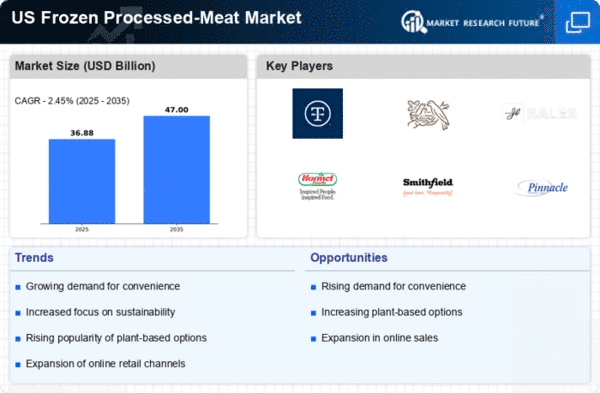

Expansion of Retail Channels

The frozen processed-meat market is experiencing growth due to the expansion of retail channels, including online grocery shopping and convenience stores. The rise of e-commerce has transformed the way consumers purchase food, with many opting for the convenience of online shopping. Data shows that online grocery sales in the US have increased by approximately 25% in the last year. This shift is particularly beneficial for the frozen processed-meat market, as it allows for greater accessibility and variety for consumers. Retailers are increasingly stocking a diverse range of frozen processed meats, catering to the evolving preferences of consumers. This expansion of retail channels is likely to enhance market visibility and drive sales in the coming years.

Evolving Consumer Preferences

Consumer preferences are shifting towards diverse and innovative food options, which is positively impacting the frozen processed-meat market. As consumers become more adventurous in their culinary choices, there is a growing demand for unique flavors and ethnic cuisines. This trend is reflected in the increasing popularity of frozen processed meats that incorporate global flavors, such as spicy or marinated varieties. Market Research Future suggests that approximately 40% of consumers in the US are willing to try new and exotic flavors in their meals. The frozen processed-meat market is responding by expanding product lines to include these innovative options, thereby attracting a broader customer base and enhancing market growth.

Increased Focus on Food Safety

Food safety concerns are becoming increasingly prominent among consumers, driving demand for frozen processed meats. The frozen processed-meat market is perceived as a safer option due to the preservation methods that inhibit bacterial growth and extend shelf life. Recent surveys indicate that over 70% of consumers in the US prioritize food safety when making purchasing decisions. This heightened awareness has prompted manufacturers to invest in quality control measures and transparent labeling practices. As a result, the frozen processed-meat market is likely to see growth as consumers gravitate towards products that assure safety and quality, thereby reinforcing their trust in the industry.