Growing Urbanization

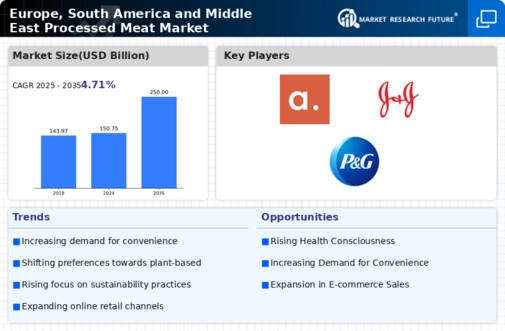

Urbanization is a significant driver of the Global Europe, South America and Middle East Processed Meat Market Industry. As more people migrate to urban areas, there is an increasing demand for processed meat products that are easily accessible and affordable. Urban consumers often seek quick meal solutions that fit their fast-paced lifestyles, leading to a higher consumption of processed meats. This trend is particularly pronounced in South America, where urban centers are expanding rapidly. The market is anticipated to grow at a CAGR of 4.71% from 2025 to 2035, reflecting the changing demographics and consumption patterns associated with urban living.

Market Growth Projections

The Global Europe, South America and Middle East Processed Meat Market Industry is poised for substantial growth in the coming years. With a projected market size of 150.75 USD Billion in 2024 and an anticipated increase to 250 USD Billion by 2035, the industry is set to expand significantly. This growth is underpinned by various factors, including rising health consciousness, urbanization, and technological advancements. The market is expected to experience a CAGR of 4.71% from 2025 to 2035, indicating a robust trajectory that reflects changing consumer preferences and market dynamics.

Rising Health Consciousness

The Global Europe, South America and Middle East Processed Meat Market Industry is experiencing a notable shift towards healthier eating habits among consumers. As individuals become increasingly aware of the nutritional content of their food, there is a growing demand for processed meats that are lower in sodium and preservatives. This trend is particularly evident in Europe, where health regulations are stringent, and consumers are opting for products that align with their health goals. The market is projected to reach 150.75 USD Billion in 2024, driven by this health-conscious consumer base, which is likely to influence product development and marketing strategies.

Sustainability and Ethical Sourcing

Sustainability concerns are increasingly influencing the Global Europe, South America and Middle East Processed Meat Market Industry. Consumers are becoming more aware of the environmental impact of their food choices, leading to a demand for ethically sourced and sustainably produced meat products. This trend is prompting manufacturers to adopt more responsible sourcing practices and to promote transparency in their supply chains. As a result, brands that prioritize sustainability are likely to gain a competitive edge in the market. This shift towards ethical consumption is expected to shape product offerings and marketing strategies, reflecting a broader societal trend towards sustainability.

Convenience and Ready-to-Eat Products

In the Global Europe, South America and Middle East Processed Meat Market Industry, the demand for convenience foods is on the rise. Busy lifestyles and the increasing number of working individuals have led to a surge in the popularity of ready-to-eat processed meat products. These items, which include pre-packaged sandwiches and microwaveable meals, cater to the need for quick meal solutions without compromising on taste. As a result, manufacturers are innovating to create products that are not only convenient but also appealing to consumers. This trend is expected to contribute to the market's growth, with projections indicating a market size of 250 USD Billion by 2035.

Technological Advancements in Processing

Technological innovations in meat processing are transforming the Global Europe, South America and Middle East Processed Meat Market Industry. Advances in preservation techniques, such as vacuum packaging and modified atmosphere packaging, enhance product shelf life and maintain quality. These technologies not only improve food safety but also allow for the introduction of new flavors and varieties, catering to diverse consumer preferences. As manufacturers adopt these technologies, they can meet the increasing demand for high-quality processed meat products. This evolution in processing is likely to play a crucial role in the market's expansion, as it aligns with consumer expectations for freshness and quality.

Leave a Comment