Growing Demand for Convenience Foods

The processed meat market in North America experiences a notable surge in demand for convenience foods. As lifestyles become increasingly fast-paced, consumers seek quick meal solutions that require minimal preparation. This trend is reflected in the rising sales of pre-packaged processed meats, which are often ready to eat or require minimal cooking. In 2025, the convenience food segment is projected to account for approximately 35% of the total processed meat market. This shift towards convenience is likely to drive innovation in packaging and product offerings, as manufacturers strive to meet consumer expectations for quality and ease of use.

Increased Focus on Food Safety and Quality

Food safety and quality have become paramount concerns for consumers in the processed meat market. In North America, regulatory bodies enforce stringent safety standards, which compel manufacturers to adopt best practices in production. This focus on safety not only enhances consumer trust but also drives market growth. In 2025, it is estimated that investments in quality assurance and safety protocols will increase by 20%, reflecting the industry's commitment to delivering safe and high-quality products. As consumers become more discerning, brands that prioritize food safety are likely to gain a competitive edge in the processed meat market.

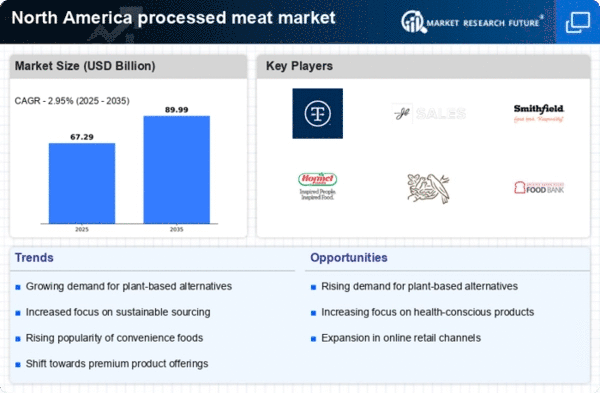

Expansion of E-commerce and Online Retailing

The rise of e-commerce has transformed the way consumers purchase processed meats in North America. Online retailing offers convenience and accessibility, allowing consumers to explore a wider range of products from the comfort of their homes. In 2025, it is projected that online sales of processed meats will account for approximately 15% of total market sales. This shift towards digital shopping is likely to encourage manufacturers to enhance their online presence and invest in direct-to-consumer channels. As e-commerce continues to grow, it presents both challenges and opportunities for the processed meat market, necessitating adaptation to changing consumer behaviors.

Evolving Consumer Preferences for Premium Products

The processed meat market in North America is witnessing a shift towards premium products as consumers increasingly seek high-quality, artisanal options. This trend is driven by a growing awareness of sourcing and production methods, with consumers willing to pay a premium for products that align with their values. In 2025, premium processed meats are expected to capture around 25% of the market share, indicating a significant shift in consumer spending habits. Brands that emphasize quality ingredients and sustainable practices are likely to thrive in this evolving landscape, as they cater to the discerning tastes of modern consumers.

Influence of Social Media and Marketing Strategies

Social media platforms play a crucial role in shaping consumer perceptions and preferences within the processed meat market. Effective marketing strategies that leverage social media can significantly impact brand visibility and consumer engagement. In 2025, it is anticipated that companies investing in targeted social media campaigns will see a 30% increase in brand awareness. This trend underscores the importance of digital marketing in reaching younger demographics who are increasingly influenced by online content. As brands navigate this dynamic landscape, those that successfully harness the power of social media are likely to gain a competitive advantage in the processed meat market.