Rising Focus on Energy Efficiency

The emphasis on energy efficiency is becoming increasingly prominent in the excitation systems market. As organizations strive to reduce operational costs and minimize environmental impact, the demand for efficient excitation systems is likely to grow. In 2025, energy-efficient technologies are projected to account for over 30% of the total market share in the excitation systems market. This shift towards efficiency not only aligns with regulatory requirements but also appeals to consumers who are more environmentally conscious. Manufacturers are thus incentivized to develop excitation systems that optimize energy use, thereby enhancing their competitive edge in the market.

Growing Demand for Power Stability

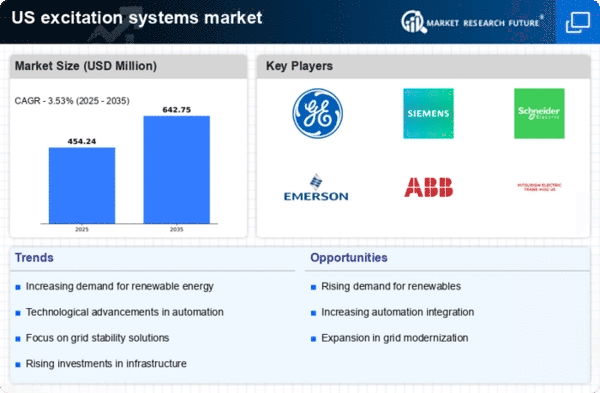

The increasing need for reliable power supply in various sectors is driving the excitation systems market. Industries such as manufacturing, healthcare, and data centers require stable power to maintain operations. As a result, the demand for excitation systems, which enhance the stability of power generation, is expected to rise. In 2025, the market is projected to reach approximately $1.5 billion, reflecting a growth rate of around 6% annually. This trend indicates that businesses are prioritizing power stability, thereby creating opportunities for innovation and investment in excitation systems. The excitation systems market is likely to benefit from this growing demand as companies seek to mitigate risks associated with power fluctuations.

Expansion of Renewable Energy Sources

The expansion of renewable energy sources is significantly influencing the excitation systems market. As the United States transitions towards cleaner energy, the integration of wind, solar, and hydroelectric power is becoming more prevalent. This shift necessitates the use of excitation systems that can effectively manage the variability associated with renewable energy generation. In 2025, it is estimated that renewable energy will contribute to over 25% of the total energy mix, thereby increasing the demand for specialized excitation systems. The excitation systems market is likely to see growth as companies develop solutions tailored to the unique challenges posed by renewable energy sources.

Increased Investment in Infrastructure

The ongoing investment in infrastructure development across the United States is significantly impacting the excitation systems market. With the government allocating substantial funds for upgrading power plants and transmission networks, the need for advanced excitation systems becomes apparent. In 2025, infrastructure spending is expected to exceed $1 trillion, with a notable portion directed towards enhancing power generation capabilities. This investment is likely to stimulate the excitation systems market, as modern systems are essential for improving efficiency and reliability in power generation. Consequently, manufacturers are encouraged to innovate and provide solutions that meet the evolving demands of the infrastructure sector.

Technological Integration in Power Generation

The integration of advanced technologies in power generation is reshaping the excitation systems market. Innovations such as digital controls, automation, and real-time monitoring are becoming standard in modern power plants. This technological evolution is expected to drive the excitation systems market, as operators seek systems that can seamlessly integrate with existing infrastructure. By 2025, it is anticipated that over 40% of new installations will incorporate these advanced technologies, reflecting a shift towards smarter power generation solutions. This trend suggests that companies must adapt to technological advancements to remain competitive in the excitation systems market.