Market Growth Projections

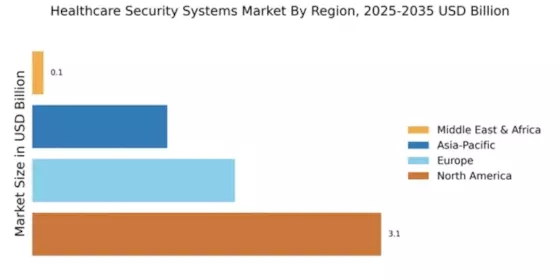

The Global Healthcare Security Systems Market Industry is poised for substantial growth, with projections indicating a rise from 13.2 USD Billion in 2024 to 18.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 3.16% from 2025 to 2035. Various factors contribute to this expansion, including increasing cybersecurity threats, regulatory compliance requirements, and the integration of advanced technologies. As healthcare organizations prioritize security measures, the market is likely to witness a surge in investments aimed at enhancing security frameworks. This upward trend reflects the industry's commitment to safeguarding patient information and ensuring the integrity of healthcare systems.

Expansion of Telehealth Services

The expansion of telehealth services is reshaping the Global Healthcare Security Systems Market Industry. As healthcare providers increasingly offer remote consultations and digital healthcare solutions, the need for secure communication channels becomes paramount. Telehealth platforms must incorporate robust security measures to protect patient data during virtual interactions. This trend is likely to drive investments in healthcare security systems, as organizations seek to ensure compliance with privacy regulations while delivering convenient services. The anticipated growth of the market to 13.2 USD Billion in 2024 underscores the urgency of addressing security concerns associated with telehealth. As telehealth continues to evolve, security will remain a critical focus area.

Increasing Cybersecurity Threats

The rise in cybersecurity threats poses a substantial challenge to the Global Healthcare Security Systems Market Industry. As healthcare organizations increasingly rely on digital systems for patient data management, the risk of data breaches escalates. In 2024, the market is projected to reach 13.2 USD Billion, driven by the need for robust cybersecurity measures. Healthcare facilities are investing in advanced security systems to protect sensitive information from cyberattacks. This trend is likely to continue, as the industry recognizes the importance of safeguarding patient data and maintaining trust. The potential financial repercussions of data breaches further underscore the urgency of enhancing security protocols.

Growing Demand for Patient Privacy

The growing demand for patient privacy significantly influences the Global Healthcare Security Systems Market Industry. Patients increasingly expect their personal health information to be protected, prompting healthcare organizations to prioritize security measures. This heightened awareness of privacy concerns drives investments in security systems that ensure confidentiality and data integrity. As the market evolves, healthcare providers are likely to adopt more sophisticated solutions to address these concerns. The projected growth to 18.6 USD Billion by 2035 reflects the industry's commitment to enhancing patient trust through improved security measures. Consequently, organizations are compelled to align their security strategies with patient expectations.

Regulatory Compliance Requirements

Regulatory compliance remains a critical driver for the Global Healthcare Security Systems Market Industry. Governments worldwide impose stringent regulations to ensure the protection of patient information and the integrity of healthcare systems. Compliance with standards such as HIPAA in the United States necessitates the implementation of comprehensive security measures. As healthcare organizations strive to meet these requirements, investments in security systems are expected to increase. The market's growth trajectory is supported by the anticipated rise to 18.6 USD Billion by 2035, reflecting the ongoing commitment to regulatory adherence. Failure to comply can result in severe penalties, further motivating healthcare providers to enhance their security infrastructure.

Integration of Advanced Technologies

The integration of advanced technologies is transforming the Global Healthcare Security Systems Market Industry. Innovations such as artificial intelligence, machine learning, and Internet of Things (IoT) devices are enhancing security measures within healthcare facilities. These technologies enable real-time monitoring, threat detection, and automated responses to security incidents. As healthcare providers seek to improve operational efficiency and patient safety, the adoption of these technologies is likely to accelerate. This trend contributes to the projected compound annual growth rate (CAGR) of 3.16% from 2025 to 2035, as organizations recognize the value of leveraging technology to bolster security frameworks and mitigate risks.