Rise of E-commerce and Online Retail

The rise of e-commerce and online retail platforms is transforming the landscape of the digestive enzyme-supplements market. With the convenience of online shopping, consumers are increasingly turning to digital channels to purchase health supplements. This shift is evidenced by a reported increase of over 30% in online sales of dietary supplements in recent years. E-commerce platforms provide consumers with access to a wider variety of products, detailed information, and customer reviews, enhancing their purchasing experience. As more consumers opt for online shopping, companies in the digestive enzyme-supplements market are likely to invest in digital marketing strategies and optimize their online presence to capture this growing segment.

Aging Population and Digestive Issues

The aging population in the United States is a critical factor influencing the digestive enzyme-supplements market. As individuals age, they often experience a decline in digestive enzyme production, leading to various gastrointestinal issues. This demographic shift is expected to drive demand for digestive enzyme supplements, as older adults seek solutions to improve their digestive health. Market analysis suggests that the segment targeting seniors could account for a substantial share of the market, potentially reaching $1 billion by 2027. The need for effective digestive support among this population is likely to propel innovation and product development within the industry, as manufacturers aim to cater to the specific needs of older consumers.

Health Consciousness and Preventive Care

The rising trend of health consciousness and preventive care among consumers is significantly impacting the digestive enzyme-supplements market. Individuals are increasingly adopting proactive approaches to health, seeking supplements that can prevent digestive issues rather than merely treating them. This shift in consumer behavior is reflected in market data, which shows that preventive health supplements are gaining traction, with a projected growth rate of 10% annually. As consumers prioritize long-term health benefits, the demand for digestive enzyme supplements that promote optimal digestion and nutrient absorption is likely to increase. This trend encourages manufacturers to innovate and develop products that align with the preventive health mindset.

Increasing Awareness of Digestive Health

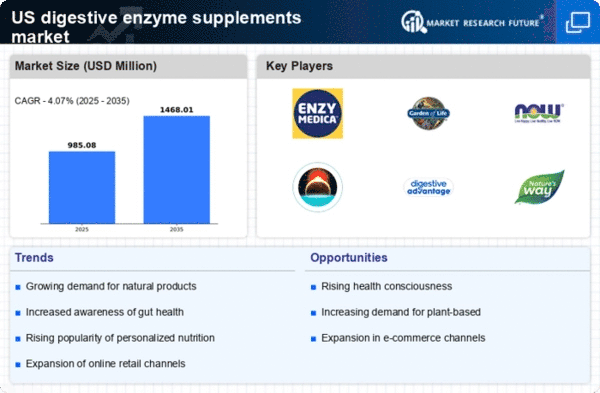

The growing awareness surrounding digestive health is a pivotal driver for the digestive enzyme-supplements market. Consumers are increasingly recognizing the importance of gut health in overall well-being, leading to a surge in demand for products that support digestive functions. This trend is reflected in market data, which indicates that the digestive enzyme-supplements market is projected to grow at a CAGR of approximately 8% over the next five years. As individuals seek to alleviate digestive discomfort and enhance nutrient absorption, the market is likely to witness a significant uptick in sales. Furthermore, educational campaigns by health organizations and influencers are contributing to this heightened awareness, encouraging consumers to prioritize digestive health in their daily routines.

Influence of Social Media and Health Trends

The influence of social media and emerging health trends significantly shapes the digestive enzyme-supplements market. Platforms such as Instagram and TikTok have become vital channels for health influencers to promote digestive health products, creating a buzz around specific supplements. This trend appears to drive consumer interest and purchasing decisions, particularly among younger demographics. Market Research Future indicates that products endorsed by influencers can see sales increases of up to 50% within weeks of promotion. As social media continues to shape consumer perceptions and preferences, companies in the digestive enzyme-supplements market may increasingly leverage these platforms for marketing and brand awareness.