Growth in End-User Industries

The coating equipment market is poised for growth, driven by the expansion of key end-user industries such as automotive, aerospace, and construction. As these sectors recover and expand, the demand for high-performance coatings is expected to rise. For example, the automotive industry is projected to grow at a CAGR of 4% through 2026, leading to increased investments in coating technologies that enhance durability and aesthetics. Additionally, the construction sector's focus on infrastructure development is likely to further stimulate demand for protective coatings. This growth in end-user industries is anticipated to contribute to a robust increase in the coating equipment market, with estimates suggesting a market value exceeding $10 billion by 2027.

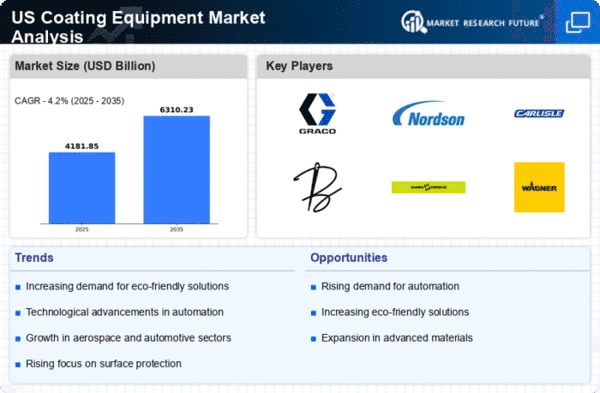

Rising Demand for Eco-Friendly Coatings

The coating equipment market is experiencing a notable shift towards eco-friendly coatings, driven by increasing environmental regulations and consumer preferences for sustainable products. As industries such as automotive and construction seek to reduce their carbon footprint, the demand for low-VOC and water-based coatings is on the rise. This trend is reflected in the market data, which indicates that eco-friendly coatings are projected to account for approximately 30% of the total coating equipment market by 2026. Manufacturers are investing in advanced coating technologies that align with these sustainability goals, thereby enhancing their market competitiveness. The coating equipment market is thus likely to benefit from this growing emphasis on environmentally responsible practices, as companies strive to meet both regulatory requirements and consumer expectations.

Regulatory Compliance and Safety Standards

The coating equipment market is significantly impacted by stringent regulatory compliance and safety standards imposed by government agencies. These regulations aim to minimize environmental impact and ensure worker safety, compelling manufacturers to adopt advanced coating technologies that meet these requirements. For instance, the introduction of the EPA's National Emission Standards for Hazardous Air Pollutants (NESHAP) has led to a shift towards low-emission coating processes. Companies that proactively adapt to these regulations are likely to gain a competitive edge in the coating equipment market. As compliance becomes increasingly critical, investments in innovative equipment that adheres to safety and environmental standards are expected to rise, potentially driving market growth by 10% over the next few years.

Technological Innovations in Coating Processes

Technological advancements are significantly influencing the coating equipment market, with innovations in automation and digitalization enhancing efficiency and precision. The integration of Industry 4.0 technologies, such as IoT and AI, is enabling manufacturers to optimize their coating processes, reduce waste, and improve product quality. For instance, automated spray systems and robotic arms are becoming increasingly prevalent, allowing for consistent application and reduced labor costs. Market analysis suggests that the adoption of these technologies could lead to a 15% increase in productivity within the coating equipment market by 2025. As companies continue to invest in cutting-edge technologies, the overall landscape of the coating equipment market is expected to evolve, fostering greater competitiveness and innovation.

Increased Focus on Customization and Specialty Coatings

The coating equipment market is witnessing a growing emphasis on customization and specialty coatings, as industries seek tailored solutions to meet specific performance requirements. This trend is particularly evident in sectors such as electronics and medical devices, where unique coating properties are essential for product functionality. The demand for specialty coatings, including anti-microbial and heat-resistant options, is projected to grow at a CAGR of 5% through 2026. Manufacturers are responding by developing advanced coating equipment that can accommodate diverse formulations and application techniques. This focus on customization is likely to enhance the competitive landscape of the coating equipment market, as companies strive to offer innovative solutions that cater to the evolving needs of their clients.