Growth of Smart Cities

The development of Smart Cities in the US is a notable driver for the CCTV camera market. As urban areas evolve, the need for integrated surveillance systems becomes paramount to ensure public safety and efficient city management. Smart city initiatives often incorporate advanced cctv solutions to monitor traffic, manage crowds, and enhance emergency response capabilities. This trend is likely to propel the market forward, with investments in smart infrastructure projected to exceed $100 billion by 2026. Consequently, The CCTV camera market is poised to experience substantial growth as municipalities prioritize safety and efficiency.

Increasing Security Concerns

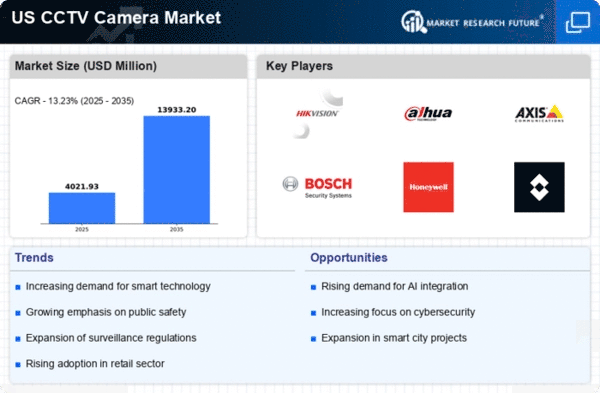

The growing apprehension regarding safety and security in various sectors, including residential, commercial, and public spaces, is a primary driver for the cctv camera market. As crime rates fluctuate, individuals and organizations are increasingly investing in surveillance systems to deter criminal activities. In 2025, the market is projected to reach approximately $5 billion, reflecting a compound annual growth rate (CAGR) of around 10% over the next five years. This heightened focus on security is prompting businesses to adopt advanced cctv solutions, thereby expanding the market's reach and potential.

Rising Demand for Remote Monitoring

The increasing need for Remote Monitoring solutions is reshaping the CCTV camera market. With the proliferation of mobile devices and internet connectivity, users are seeking systems that allow them to monitor their properties from anywhere. This demand is particularly evident in residential settings, where homeowners desire peace of mind while away. The market is witnessing a shift towards cloud-based storage and remote access features, which enhance user experience. As a result, the cctv camera market is expected to grow by approximately 12% annually, driven by this trend towards convenience and accessibility.

Technological Advancements in Imaging

Innovations in imaging technology, such as high-definition (HD) and 4K resolution cameras, are significantly influencing the cctv camera market. Enhanced image quality allows for better identification and monitoring, which is crucial for effective surveillance. The integration of features like night vision, motion detection, and remote access capabilities further enhances the appeal of these systems. As consumers demand more sophisticated solutions, manufacturers are compelled to innovate, leading to a competitive landscape that fosters growth. The market is expected to benefit from these advancements, with a projected increase in sales by 15% annually.

Regulatory Support for Surveillance Technologies

Government regulations and initiatives aimed at enhancing public safety are fostering growth in the cctv camera market. Various federal and state programs encourage the adoption of surveillance technologies in public spaces, schools, and transportation systems. This regulatory support not only promotes the installation of cctv systems but also provides funding opportunities for municipalities. As a result, the market is likely to see an influx of investments, with projections indicating a potential increase in market size by 20% over the next five years. This supportive environment is crucial for the sustained expansion of the cctv camera market.