Rising Security Concerns

The increasing concerns regarding security and safety in urban areas of Japan appear to be a primary driver for the cctv camera market. With a notable rise in crime rates in certain regions, there is a growing demand for surveillance solutions. According to recent statistics, the crime rate in urban centers has seen fluctuations, prompting both businesses and residential areas to invest in security measures. The cctv camera market is witnessing a surge in demand as individuals and organizations seek to enhance their security infrastructure. This trend is likely to continue as public awareness of safety issues grows, leading to further investments in advanced surveillance technologies.

Regulatory Compliance and Standards

The establishment of stringent regulatory frameworks and compliance standards in Japan is driving the cctv camera market. Organizations are required to adhere to specific guidelines regarding surveillance practices, data protection, and privacy. This regulatory environment compels businesses to invest in compliant cctv systems that meet legal requirements. The cctv camera market is likely to benefit from this trend, as companies seek to avoid penalties and enhance their operational integrity. Furthermore, the emphasis on data security and privacy is expected to lead to increased demand for advanced cctv solutions that incorporate robust encryption and data management features.

Urbanization and Infrastructure Development

Japan's rapid urbanization and ongoing infrastructure development are significantly influencing the cctv camera market. As cities expand and new commercial and residential projects emerge, the need for effective surveillance systems becomes increasingly critical. The government has allocated substantial budgets for urban development, which includes the installation of cctv systems in public spaces. This investment is expected to reach approximately ¥500 billion by 2026, indicating a robust growth trajectory for the cctv camera market. Enhanced surveillance capabilities are essential for managing urban environments, ensuring public safety, and monitoring traffic, thereby driving demand for cctv solutions.

Technological Integration in Security Systems

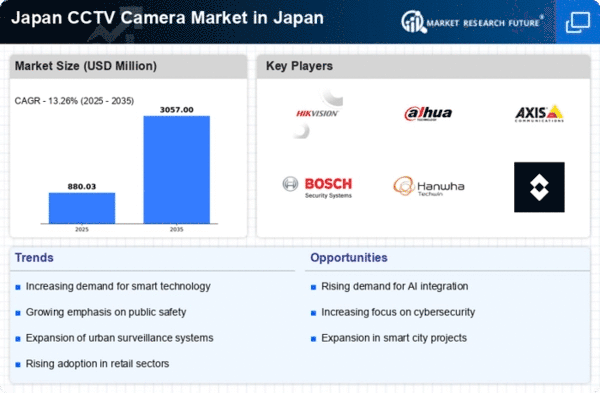

The integration of advanced technologies such as artificial intelligence (AI) and machine learning into security systems is transforming the cctv camera market. These innovations enable smarter surveillance solutions that can analyze footage in real-time, detect anomalies, and provide actionable insights. The cctv camera market is experiencing a shift towards these intelligent systems, which are becoming increasingly popular among businesses and government entities. As organizations seek to optimize their security operations, the demand for AI-enabled cctv cameras is projected to grow by 30% over the next five years. This trend reflects a broader movement towards automation and efficiency in security management.

Growing Demand in Retail and Commercial Sectors

The retail and commercial sectors in Japan are increasingly adopting cctv systems to enhance security and improve operational efficiency. With the rise of e-commerce and competitive retail environments, businesses are recognizing the importance of surveillance in protecting assets and ensuring customer safety. The cctv camera market is projected to see a growth rate of 25% in these sectors over the next few years. Retailers are investing in high-definition cameras and integrated security systems to monitor customer behavior and prevent theft. This trend underscores the critical role of cctv technology in modern business operations, driving further expansion in the market.