Technological Advancements

Technological advancements play a pivotal role in shaping the cctv camera market. Innovations such as high-definition imaging, night vision capabilities, and wireless connectivity are transforming the landscape of surveillance. The introduction of smart cameras equipped with AI features is particularly noteworthy, as these devices can analyze footage in real-time and provide actionable insights. This evolution in technology is likely to attract a broader customer base, including both residential and commercial sectors. The market is anticipated to witness a substantial increase in sales, with estimates suggesting a potential revenue growth of £1 billion by 2027. As technology continues to evolve, the cctv camera market is poised for further expansion, driven by consumer demand for cutting-edge surveillance solutions.

Increasing Security Concerns

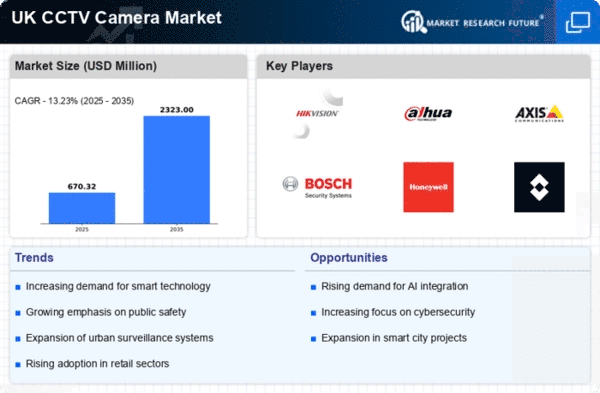

The cctv camera market is experiencing growth driven by escalating security concerns among businesses and households in the UK. With rising crime rates and the need for enhanced surveillance, the demand for cctv cameras has surged. According to recent data, the market is projected to grow at a CAGR of approximately 8% over the next five years. This trend indicates that consumers are increasingly prioritizing safety and security, leading to a higher adoption of cctv systems. Furthermore, the integration of advanced technologies, such as motion detection and remote monitoring, is likely to enhance the appeal of these systems. As a result, The CCTV camera market is expected to grow significantly, catering to the growing need for reliable security solutions.

Regulatory Compliance and Standards

Regulatory compliance and standards set forth by the UK government significantly influence the CCTV camera market. As privacy concerns grow, regulations surrounding data protection and surveillance practices are becoming more stringent. Businesses are required to adhere to guidelines that govern the use of cctv systems, which in turn drives the demand for compliant technology. The Information Commissioner's Office (ICO) has established clear guidelines for the use of surveillance cameras, emphasizing the importance of transparency and accountability. This regulatory landscape is likely to propel the market forward, as companies seek to invest in cctv solutions that meet legal requirements. Consequently, The CCTV camera market is expected to expand as organizations prioritize compliance alongside security.

Growing E-commerce and Retail Sector

The growth of the e-commerce and retail sector is significantly impacting the cctv camera market. With the rise of online shopping, brick-and-mortar stores are increasingly adopting surveillance systems to protect their assets and ensure customer safety. Retailers are investing in cctv solutions to deter theft and monitor customer behavior, which can enhance the shopping experience. Recent statistics indicate that the retail sector in the UK is projected to reach £500 billion by 2026, further driving the demand for effective security measures. As businesses recognize the importance of safeguarding their premises, the cctv camera market is likely to see a surge in demand, reflecting the evolving landscape of retail security.

Urbanization and Infrastructure Development

Urbanization and infrastructure development are key drivers of the cctv camera market in the UK. As cities expand and populations increase, the need for effective surveillance systems becomes more pronounced. Urban areas are particularly vulnerable to crime, necessitating the installation of cctv cameras in public spaces, transportation hubs, and commercial establishments. The UK government has been investing in smart city initiatives, which often include enhanced surveillance capabilities. This trend is likely to result in a substantial increase in the deployment of cctv systems, with projections indicating a market growth of approximately 10% over the next few years. As urban environments evolve, The CCTV camera market is anticipated to thrive, driven by the demand for improved safety and security.